[1]

STATE OF MICHIGAN

DEPARTMENT OF INSURANCE AND FINANCIAL SERVICES

Bulletin 2024-14-INS

In the matter of:

2025 Form and Rate Filing

Requirements for Medical Plans

_____________________________/

Issued and entered

this 16

th

day of April

by Anita G. Fox

Director

SECTION 1: CERTIFICATION AND RECERTIFICATION FILING REQUIREMENTS FOR MEDICAL PLANS

ON- AND OFF-MARKETPLACE

General Information

DIFS will continue to perform Plan Management Functions for Plan Year 2025 (PY25). Plan Management

functions are part of DIFS’ regulatory role for products offered on- and off-Marketplace. Issuers will work directly

with DIFS to submit all Qualified Health Plan (QHP) application data in accordance with federal and state

guidelines. SERFF will be used by issuers to transmit information to DIFS, and DIFS will use SERFF to transmit

information to the Centers for Medicare & Medicaid Services (CMS).

Many of the same guidelines apply to issuers filing plans offered off-Marketplace and these items are referenced

in this Bulletin.

Issuers will again be required by CMS to be registered for the CCIIO Plan Management Community. This

platform will be utilized to issue all notices, including corrections and notifications.

New Information

Pursuant to the PY25 Notice of Benefit and Payment Parameters, CMS will impose a limit of two non-

Standardized Plans per product network and metal level unless the plan qualifies for an exceptions process to

the limitation. Additionally, due to AV constraints, there will be no Standardized Option for a non-expanded

bronze plan. Finally, all Standardized Plans must include zero cost-share preventive drugs in Tier One.

Under the referenced exceptions process, for PY25 and subsequent years, an issuer may offer additional non-

standardized plan options beyond the limit of two for each product network type, metal level, inclusion of dental

and/or vision benefit coverage, and service area if it demonstrates that these additional plans’ cost sharing for

benefits pertaining to the treatment of chronic and high-cost conditions (including benefits in the form of

prescription drugs, if pertaining to the treatment of the condition(s)) is at least 25% lower, as applied without

restriction in scope throughout the plan year, than the cost sharing for the same corresponding benefits in an

issuer’s other non-standardized plan option offerings in the same product network type, metal level, inclusion of

dental and/or vision benefit coverage, and service area.

[2]

New information specific to Network Adequacy can be found in Section 1 of this Bulletin under the applicable

heading.

DIFS will be ensuring Plan names are accurate in describing available benefits. Plan names may not include

references to cost sharing and must be consistent across all templates and documents.

New Plans and Recertification of QHPs

For PY25, DIFS’ process for certification and recertification of a QHP is consistent with the process used in

prior plan years. Issuers submitting previously approved plans for recertification will be required to submit much

of the same information as for prior plan years. Issuers submitting plans for certification for the first time should

review the pertinent federal and state guidance. The omission of any federal or state requirement from this

Bulletin should not be construed to mean that compliance with those requirements is not necessary.

For additional guidance, issuers are urged to refer to the 2025 Letter to Issuers.

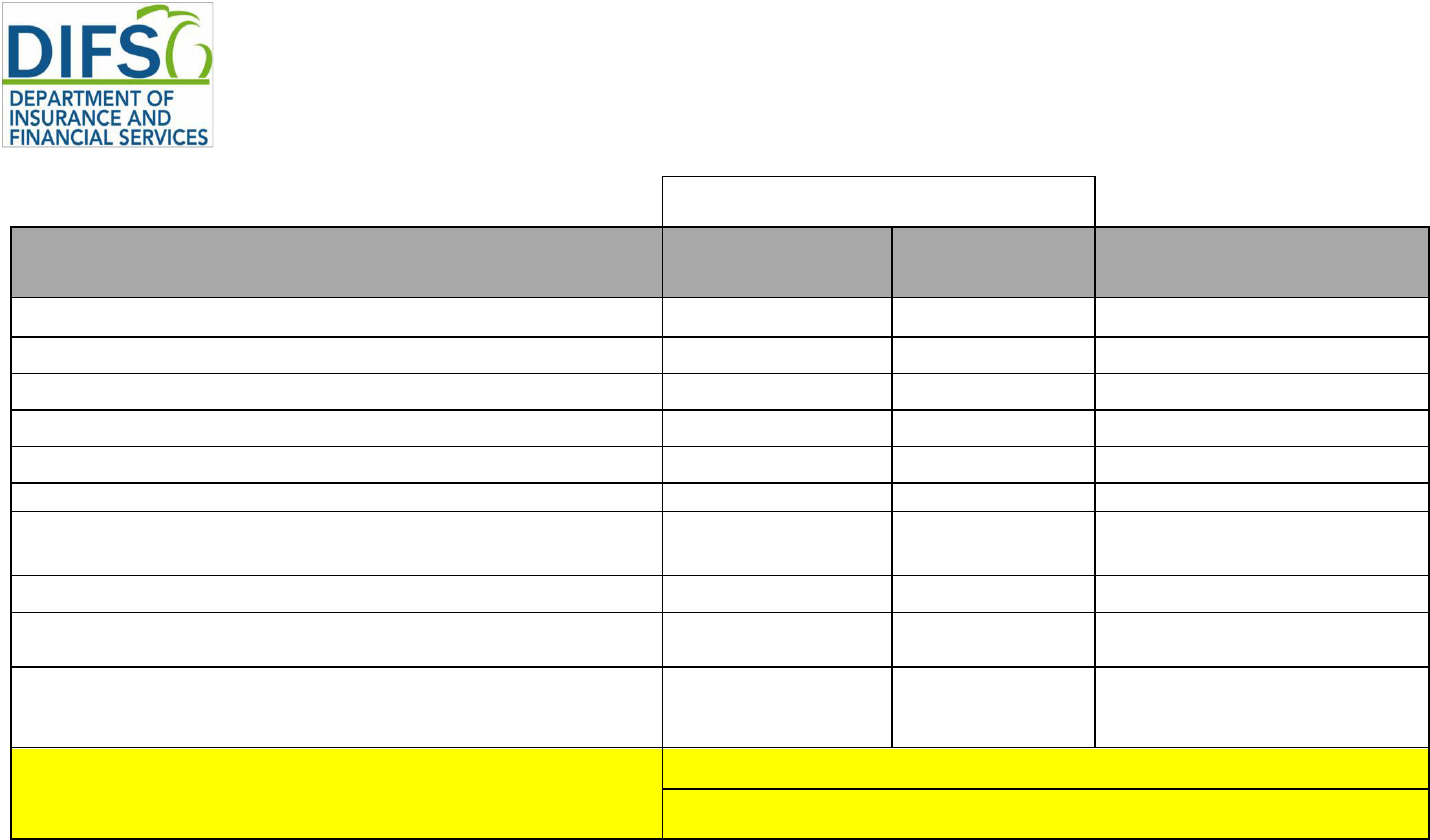

PY25 SUBMISSION TIMELINES

DIFS has established the following submission dates for Michigan issuers to file their proposed Forms, Rates,

and Binders for PY25 for small group and individual markets:

Small Group

Small group issuers submit Forms, Rates, and Binders for all on- and off- Marketplace plans in SERFF by

May 15, 2024. Rate filing justification Parts I, II, and III will be submitted in the Form/Rate filing in the URRT

Tab. See Exhibits 1 and 2 for the list of required templates and documents.

Individual

Individual issuers submit Forms, Rates, and Binders for all on- and off- Marketplace plans in SERFF by May

29, 2024. Rate filing justification Parts I, II, and III will be submitted in the Form/Rate filing in the URRT Tab.

See Exhibits 1 and 2 for the list of required templates and documents.

These are to be the issuers’ final rates. Note: DIFS will not accept changes to the Rates Table Template after

the submission deadline unless the changes are required by DIFS as part of the rate review process.

[3]

Timeline for Medical Submissions

Activity

Small Group

Dates

Individual

Dates

Medical

Application

Submission and

Review Process

Filing Deadline – Forms & Rates and Binder 05/15/2024 05/29/2024

DIFS’ 1

st

transfer of plan data to CMS;

Transparency in Coverage and Plan ID Crosswalk

Templates submission deadline

6/12/24

CMS reviews and posts initial QHP application

results in PM Community

6/13/24 to 7/12/24

DIFS’ 2

nd

transfer of plan data to CMS 7/17/24

Final Review

DIFS’ final transfer of plan data to CMS 8/14/24

CMS reviews and posts final QHP application

results in PM Community

8/15/24 to 9/09/24

QHP

Agreement/

Final

Certification

CMS sends Certification Notices

9/10/24

Limited data correction window and last date to

withdraw plans

9/12/24 to 9/13/24

CMS posts QHP agreements; Issuers send signed

agreements; States confirm final plan

recommendations.

10/1/24 to 10/2/24

Open Enrollment Begins 11/1/24

[4]

PY25 Filing Requirements and Templates

A complete submission includes the SERFF Form/Rate filing and Binder, with all required validated templates

and associated items, as outlined in Exhibit 1. Issuers are required to run the QHP Application Review Tools,

including the Data Integrity Tool for the initial and all subsequent template submissions. Review tool results

containing errors must be corrected prior to submission.

All template revisions made during DIFS’ review must be uploaded to the same locations as originally filed, i.e.,

filing, Binder, or both. See Exhibit 1.

Note: Only one Business Rules Template and Transparency in Coverage Template needs to be completed.

Each template should include both individual and small group plans and be submitted in the SERFF Binder.

The exception is that the Transparency Coverage Template is not required for off-Marketplace only

submissions.

PY25 Quality Improvement Strategy Filing Requirement

The Quality Improvement Strategy (QIS) standards include requiring issuers to address their efforts to reduce

healthcare disparities in addition to the previous requirement to report on a QIS that includes at least one topic

area defined in section 1311(g) of the Affordable Care Act.

Issuers should consult the QHP Certification Application Materials for instructions on how to meet the QIS

requirements for the PY25 QHP Application Period. Issuers must complete and submit a QIS Implementation

Plan and Progress Report Form to DIFS by submitting in the Supporting Documentation tab in the SERFF

Binder.

The deadline for submitting this form in the small group market is May 15, 2024, and the deadline for the

individual market is May 29, 2024.

PY25 Checklist Requirements

Checklists that must be completed and filed as shown in Exhibit 1 are:

• Checklist for Individual and Small Group Medical Plans– Forms (FIS 2307);

• Checklist for Individual and Small Group Medical Plans–Rates (FIS 2306); and

• Checklist for Individual and Small Group Medical Plans–Network Adequacy (FIS 2313).

Revisions to Previously Approved QHPs: Red-Lined Versions

Issuers revising previously approved QHP forms must provide red-lined versions, as well as clean versions.

The red-lined and clean versions must both be filed in the Forms Schedule tab of the SERFF Form/Rate filing

under the same document number. Note: Forms not being revised must still be submitted.

File Naming

Certain items in the Supporting Documentation tab of the Form/Rate filing and/or Binder must adhere to a

standard naming convention as follows: IssuerName_MIFormDescription_Version#. The purpose of adherence

to a standard naming convention is to have the ability to track new versions as they are updated. It is important

to start with Version 1 and use the same issuer name and form description in the file name each time. In

addition, all review tools must be run each time a template is revised.

[5]

Items that are required to have a standard naming convention are:

• DIFS Medical Forms Checklist;

• DIFS Medical Rates Checklist;

• DIFS Medical Network Adequacy Checklist;

• Rates Table Template;

• Actuarial Memorandum;

• URRT;

• MI Uniform Modification Justification Form;

• Michigan Network Adequacy Template

• Justifications and Attestations;

• Summary of Benefits and Coverage;

• Schedule of Benefits; and

• Any document that is amended from its original version that is not automatically versioned through

SERFF.

Transitional Plans

Pursuant to prior CMS guidance, Order 2024-14-M extends the transitional policy so long as policies do not

remain in force beyond December 31, 2025. Issuers with active transitional programs should develop a process

to end these policies and advise insureds of their options for coverage.

SERFF Filings

All federal and Michigan-specific templates must be filed in Excel formats. Do not submit templates in PDF.

Additionally, do not submit templates in the Supporting Documentation tab of the Binder, except for the Plan

ID Crosswalk and Michigan Network Adequacy templates.

Under Section 234 of the Michigan Insurance Code, MCL 500.234, the Director has the discretion to designate

certain records to be nonpublic. Accordingly, issuers have the option to mark their filings as confidential upon

submission. The filings will remain confidential until one day after the submission deadline at which time DIFS

will make the filings public.

Guaranteed Renewability

All individual and small group plans offered on- and off-Marketplace must comply with federal and state law

regarding guaranteed renewability, including all applicable federal regulations and guidance, and DIFS Bulletin

2011-17-INS.

Plan Withdrawal

Plans may be withdrawn in accordance with the process published in the 2025 Letter to Issuers The final

opportunity to withdraw plans will be during the plan confirmation process. Issuers opting to withdraw must

submit the following in both the SERFF Form/Rate filing and Binder:

1. A completed CMS Plan Withdrawal form for plans offered either on-Marketplace or on- and off-

Marketplace or a list of plans to be withdrawn for those offered off-Marketplace only.

2. A letter to the DIFS Director outlining the issuer’s intent and how it will comply with both state and

federal guaranteed renewability and availability requirements.

3. A copy of the proposed letter that will be sent to enrollees/consumers outlining the issuer’s intent and

[6]

detailing all options available to the enrollee/consumer, including seeking coverage from a different

issuer. This letter must not be sent to enrollees/consumers until approved by DIFS.

Note: Do not make changes to templates. Also, pursuant to Michigan statute, MCL 500.2213b(6), once an

issuer withdraws from a nongroup or group market completely, there is a 5-year waiting period during which

that issuer may not issue health coverage in the market from which it withdrew.

Uniform Modification and Plan ID Crosswalk

DIFS requires that the MI Uniform Modification Justification Form (FIS 2316) and Plan ID Crosswalk Template

be submitted as shown in Exhibit 1.

CMS requires that the Plan ID Crosswalk Template, together with authorization from DIFS, be submitted to

CCIIO Plan Management Community for QHPs in the individual market. The deadline for this submission is

June 12, 2024.

Licensure and Good Standing

DIFS will review the licensure status of all issuers filing plans on- and/or off- Marketplace.

Annual Limit on Cost-Sharing

The PY25 out-of-pocket maximums for Marketplace-certified QHPs are $9,200 for individuals and $18,400 for

families.

Changes to Cost-Sharing

After the initial transfer to CMS, changes made to copay amounts and coinsurance percentages cannot be

made without DIFS’ approval.

Service Area

Issuers must inform DIFS of any service area data change through the SERFF binder and include all templates

and supporting documentation impacted.

After DIFS’ final transfer on August 14, 2024, service area data may only be changed with DIFS’ approval and

submission of a Data Change Request (DCR) to CMS, even if the change is directed by DIFS or CMS.

Submission of the DCR to CMS is through the Plan Management Community and must include an explanation

and justification for the change(s), evidence of state approval, and the DCR Supplement.

Service area data changes include:

1. Revising Service Area Template to:

a. change any service area name or ID

b. add or remove a service area

c. add or remove a county/ies to a service area

d. change a county from full to partial

e. change a county from partial to full

f. adding or removing a zip code(s) associated with a partial county

2. Revising the Plans and Benefits Template (PBT) to:

a. change Service Area ID

[7]

b. add or remove a Service Area ID

3. Any change to the list of counties associated with a particular plan

Any service area data change must be reflected on the new Michigan Network Adequacy Template (FIS 2385).

For more information, see CMS' QHP Information and Guidance for Service Area and Data Change Windows.

Network Adequacy

New for PY25: DIFS is adding the following provider specialties in accessing network adequacy. These will be

incorporated into the Michigan Network Adequacy Template (FIS 2385). See Michigan Network Adequacy

Guidance for the associated measurement criteria.

1. Anesthesiology

2. Outpatient Dialysis

3. Durable Medical Equipment

4. Home Health

5. Home Infusion

6. Hospice

7. Clinical and Medical Laboratory

8. Certified Nurse Midwife

9. Optometrist

10. Pathology

11. Dental Oral & Maxillofacial

Surgery

12.Ambulance (Land

Transportation only)*

13. Pharmacy

The Michigan Network Adequacy Guidance reflects network sufficiency requirements and standards. See also

Checklist for Individual and Small Group Medical Plans – Network Adequacy (FIS 2313), CMS’ PY25 2025

Letter to Issuers, Notice of Benefit and Payment Parameters, and QHP Certification Information and Guidance.

* This information is being collected for informational purposes only and will not be used in evaluating network

adequacy.

Essential Community Providers

The ECP threshold remains unchanged from PY24 with a threshold of 35 percent for available ECPs in each

plan’s service area.

Issuers must complete CMS’ ECP/NA template in accordance with CMS’ instructions generally with respect to the ECP

data. For the network adequacy portion, issuers should only submit information necessary to validate the template.

Issuers must run the Medical QHP ECP Tool and submit the results in Supporting Documentation of SERFF

binder each time a change is made to the Network ID, Service Area, and ECP Templates.

See CMS’ web page QHP Certification Application Materials for Application Instructions, ECP and Network

Adequacy, and Review Tools.

Patient Safety Standards

The federal State Partnership Exchange Issuer Attestation Response Form verifying compliance with the

Patient Safety Standards in accordance with 45 CFR.156 must be submitted in Supporting Documentation of

SERFF Binder.

SECTION 2: CONTRACT REQUIREMENTS (APPLICABLE TO ALL PLANS)

Readability

[8]

Submitted forms must comply with the following readability standards found under MCL 500.2236(3):

1. Each form entered in the SERFF Form Schedule tab shall include the form’s readability score.

2. The readability score must be based on the Microsoft Word Flesch Reading Ease test and have a

score of 45 or higher. Forms with a Microsoft Word Flesch Reading Ease score lower than 45 will not

be approved by DIFS.

3. Health care policies, contracts, and certificates of coverage with more than 3,000 words printed on not

more than three pages, or more than three pages of text regardless of the number of words, shall

contain a table of contents. (This requirement does not apply to riders or endorsements.)

4. Be printed in a font size not less than 10 point.

Internal Formal Grievance and External Review Procedures

QHPs offered by commercial issuers must offer a formal grievance procedure pursuant to MCL 500.2213 and

adhere to the external review process under the Patient’s Right to Independent Review Act (PRIRA), PA 251

of 2000 (MCL 550.1901 to 550.1929). These procedures must be part of the policy and submitted for approval

with the medical filing. If the issuer has DIFS-approved grievance and external review procedures, these must

be filed in the Supporting Documentation tab of the SERFF Form/Rate filing.

Complaint and Grievance Policy and Procedures must include information on DIFS’ Health Care Appeals –

Request for External Review (FIS 0018) and contact information for DIFS including fax number, email address,

and mailing address.

Actuarial Value (AV) Requirements

All individual and small group plans offered on- and off-Marketplace must be assigned to one of the approved

“metal level” AV tiers or be classified as a catastrophic plan. Determinations of AV must conform to 45 CFR

156.140. Pursuant to the Notice of Benefit and Payment Parameters, the allowable variation in the AV for a

health plan (de minimis range) is as follows, by type of plan:

Income-based silver CSR plan variations +1 / -0 percentage points

All other individual market silver QHPs +2 / -0 percentage points

Expanded bronze plans +5 / -2 percentage points

All other plans +2 / -2 percentage points

Religious Employer Exemption

DIFS will allow issuers who qualify for contraceptive coverage exemptions under federal rules to include

additional language describing the administration of these benefits. The purpose of the additional language will

be to clarify for employees that:

1. The employer will not contract, arrange, or pay for contraceptive benefits for employees.

2. The issuer will instead provide contraceptive benefits for employees (including notification to

employee).

3. The costs for these benefits are not included in the program paid for the healthcare coverage.

ESSENTIAL HEALTH BENEFITS (EHB)

EHB Benchmark Plan

Issuers must use Michigan's 2022 EHB benchmark plan and review the benchmark to ensure their plans on-

and off-Marketplace conform to it.

[9]

Mental Health Parity and Addiction Equity Act (MHPAEA)

All individual and small group plans must comply with the federal MHPAEA and applicable regulations. Issuers

should carefully review the final rule implementing the MHPAEA, issued on November 13, 2013, and generally

applicable to plan and policy years on or after July 1, 2014. Issuers should review the final rule to determine

whether a particular plan is subject to the MHPAEA and is compliant with that statute and regulations.

Pursuant to the Consolidated Appropriations Act, 2021, all issuers must complete a Non-Quantitative Treatment

Limitations (NQTL) comparative analysis to make available to state authorities upon request. DIFS requires

submission of the NQTL analysis in the Supporting Documentation tab of the Form/Rate filing.

Actuarially Equivalent Substitutions of EHB

Actuarially equivalent substitutions of EHB are not permitted in Michigan.

Anti-Discrimination in EHB

DIFS will review policy and certificate forms for compliance with all provisions of federal and state anti-

discrimination law, including but not limited to section 1557 of the Affordable Care Act, 42 USC 18116 and MCL

500.2027.

Issuers are encouraged to review in its entirety the Final Rule on Nondiscrimination in Health Programs and

Activities, which is set forth at 45 CFR Part 92 (Final Rule). The Final Rule prohibits discrimination on the basis

of race, color, national origin, sex, age, disability, gender identity, and sexual orientation.

Rehabilitative and Habilitative Services; Autism Spectrum Disorder

All plans must cover at least 30 visits for speech therapy, plus a combined 30 visits for physical and

occupational therapy for rehabilitative services. Plans must also cover at least the same number of visits for

habilitative services. However, for treatment of autism spectrum disorder specifically, plans may not limit the

number of visits for any mandated type of treatment, including speech therapy, physical therapy, and

occupational therapy.

SECTION 3: CONTRACT REQUIREMENTS (APPLICABLE TO ON-MARKETPLACE PLANS ONLY)

Data Corrections After the Final Application Submission Deadline

Issuers must request data correction changes and receive explicit direction and approval from CMS and DIFS.

• Data change requests to CMS must be initiated in the Plan Management Community, include an

explanation and justification for each requested change, and evidence of DIFS’ approval. Issuers

should work with DIFS to make any change.

• URL changes must be approved by DIFS (CMS authorization is not required) before making changes

in the MPMS.

• Post-Certification Assessment(s) received from CMS require issuers to communicate to DIFS how

errors or corrections were addressed.

Once SERFF Binders are closed, DIFS will only reopen the Binder for issuers to make data changes approved

[10]

by CMS. Issuers must provide DIFS with evidence of CMS’ approval for each data change.

Accreditation

45 CFR 155.1045 establishes the timeline by which issuers offering plans on- Marketplace must be accredited

by NCQA, URAC, or AAAHC. An issuer’s accreditation status will be available to consumers at the Marketplace

website. Please include Accrediting Information in the SERFF Binder in the Company and Contact tab.

Summary of Benefits and Coverage and Schedule of Benefits

DIFS requires use of the 2021 form of Summary of Benefits and Coverage (SBC) as posted by CCIIO on

February 3, 2020. This form applies to individual and small group on-Marketplace plans. The materials are

available here. Each plan must have its own unique SBC, with the associated URL link, submitted via the

MPMS Module.

For PY25, DIFS requires issuers file the required SBCs in the forms tab of the Form/Rate filing. The SBC and

the Schedule of Benefits must include the Plan ID from the Plans and Benefits Template in the name. Each

SBC must then be associated with the Plan to which it applies in the Binder. The requirements for unique SBCs

and URL link filings remain the same as in PY23.

SECTION 4: RATING REQUIREMENTS (APPLICABLE TO ALL PLANS)

DIFS will not accept more than one filing per market (individual or small group). Issuers that offer both PPO/EPO

and HMO/POS must submit both filings in the same Form/Rate filing.

Per 45 CFR 154.200, the Part II Justification remains at 15% and is applicable by plan, not the overall rate

change.

Required Cost-Sharing Variations for Individual Market Plans Only

45 CFR 156.420 requires several cost-sharing plan variations for issuers offering coverage in the individual

market on-Marketplace. Issuers must submit for approval the three plan variations for each silver plan offered,

and the zero and limited cost-sharing variations for each plan at the platinum, gold, silver, and bronze metal

levels.

In August 2020, the Court of Appeals of the Federal Circuit Court concluded that issuers are entitled to unpaid

CSRs, with the expectation that the unpaid CSRs will be offset in some manner for issuers’ CSR premium

loading. The decision could lead to CSR payments being restored by either Congress or HHS, but neither has

taken action to date. As a result, DIFS will continue to require issuers to submit rates assuming no CSR

payments will be made (CSR load) for PY25. If CSR payments are restored by either Congress or HHS prior

to the finalization of rates, DIFS may require companies to update their rates to remove the CSR provision.

These rates apply only to on-Marketplace silver plan premiums.

The actuarial memorandum should disclose the amount of CSR load included in the silver plan rates and a

detailed description of the methodology for determining the load. The CSR load should reflect reasonably

anticipated CSR costs, using the expected cost sharing and distribution of enrollees across the silver plan

variants. Issuers that develop CSR loads at the plan level should clearly identify the CSR loads for each plan

and provide the member distributions and expected unfunded subsidies that support each plan’s CSR load. If

historic ACA incurred/paid claims were used to develop the Cost-Sharing Design factor, the impact of CSR

subsidies in the experience period is already included and will need to be removed before applying the CSR

[11]

Defunding Adjustment. Otherwise, the impact of CSR subsidies would be double counted in the projection

period.

Rating Factors

Rates may vary based only on the following factors:

• Rating area

• Age (within a ratio of 3:1 for adults)

• Tobacco use (within a ratio of 1.5:1)

Additional Michigan Rating Factor Determinations

Michigan has made the following determinations related to the allowable rating factors, applicable to all

individual and small group plans:

Age Rating

Michigan plans must adhere to the 3:1 ratio and federal default age curve for both individual and small group

markets. The federal default age curve, applicable for plan years beginning on or after January 1, 2018, is

detailed in the CMS Insurance Standards Bulletin: Guidance Regarding Age Curves and State Reporting, Dec.

16, 2016.

Tobacco Ratio

Issuers will not be required to use a tobacco ratio less than 1.5:1. Issuers will be allowed to vary their tobacco

ratio based on age, if the ratio does not exceed 1.5:1 for any specific age.

Standard Family Tier

Michigan will not allow the use of a standard family tier.

Per-Member Rating

Michigan requires per-member rating in the small group market. Issuers wishing to offer small employers the

option to be billed on an equivalent

composite premium basis must comply with the requirements set forth at

45 CFR 147.102(c)(3), including the development of separate composite premiums for individuals age 21 and

older and individuals under age 21.

Geographic Rating

Michigan will continue using the previously defined 16 geographic rating areas for both the individual and small

group market. The 16 defined geographic areas, within each of the 83 counties in Michigan, labeled A through

P, can be found here.

Merging of Markets

Pursuant to 45 CFR 156.80, Michigan requires issuers to maintain separate risk pools for the individual and

small group markets.

[12]

SECTION 5: WELLNESS PLANS

General Guidelines

A wellness program may be offered with any plan provided it.

• Meets the requirements of 45 CFR 146 and 147, and

• Is filed as part of the plan and approved by DIFS

• Cannot be contingent on COVID-19 vaccination status

Small Group Plans that Rate for Tobacco Use

Issuers must include a health-contingent wellness plan in the small group market if they are rating for tobacco

use. The plan must provide for a reduction or elimination of the tobacco rating if the insured participates in a

tobacco cessation program. The plan must also meet the requirements stated in the General Guidelines above.

The plan materials must describe the conditions and benefits of the wellness plan; simply stating that a wellness

plan is offered is not sufficient.

Any questions regarding this bulletin should be directed to:

Department of Insurance and Financial Services

Office of Insurance Rates and Forms

530 W. Allegan Street—7

th

Floor

Lansing, Michigan 48933

Toll Free: (877) 999-6442

/s/

_________________________________________

Anita G. Fox

Director

[13]

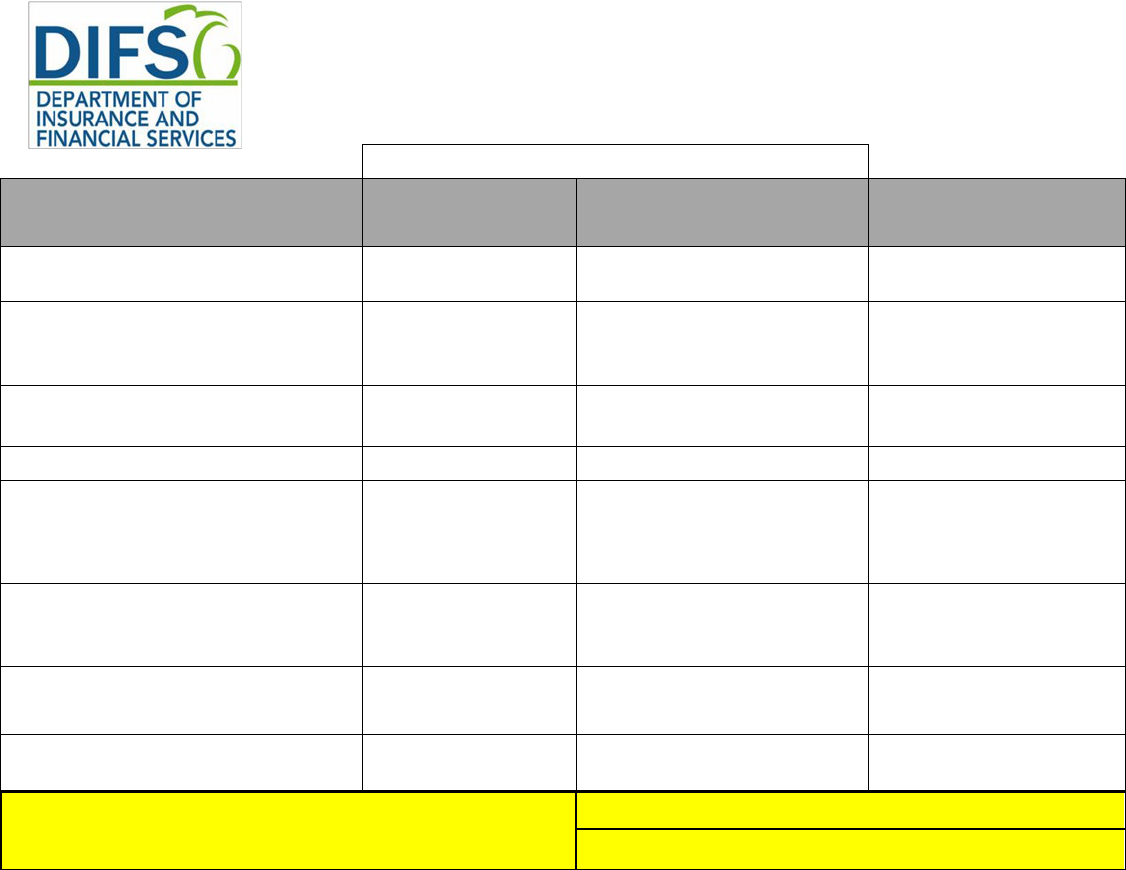

Exhibit 1 – FORMS

PY25 Medical Plans Filing Requirements

Requires Submission via SERFF

Federal Required Templates

On- and On-/Off-

Marketplace

Off-Marketplace SERFF Location:

Essential Community Providers/Network Adequacy

Yes

No

Binder only

Plans and Benefits

Yes

Yes

Binder only

Service Area

Yes

Yes

Binder only

Network ID

Yes

Yes

Binder only

Prescription Drug

Yes

Yes

Binder only

Rates Table

Yes

Yes

Form/Rate Filing & Binder

Business Rules – One per Issuer, include both Individual and Small

Group on the same template

Yes

Yes Binder only

Accreditation

Yes

No

Binder only

Plan ID Crosswalk (Individual only; Supporting

Documentation tab)

Yes

No

Binder only

Transparency in Coverage – One per Issuer, include both

Individual and Small Group on the same template (not required for

off-Marketplace only)

Yes

No

Binder only

Filing Deadlines

Small Group 5/15/2024

Individual 5/29/2024

[14]

Requires Submission via SERFF

Michigan Required Supporting Documentation

On- and On-/Off-

Marketplace

Off-Marketplace SERFF Location:

Service Area Partial County Supplemental Response Justification, as

applicable.

Yes

Yes

Binder only

Michigan Network Adequacy Template (FIS 2385)

(Supporting Documentation tab)

Yes

Yes

Binder only

Network Attestation

Yes

Yes

Binder only

Network Coverage Attestation

Yes

Yes

Binder only

Appointment Wait Time Attestation

Yes

Yes

Binder only

Medical QHP ECP Tool Analysis/Results

Yes

No

Binder only

Network Submission Summary

Yes

Yes

Binder only

Checklist for Individual and Small Group Medical Plans – Forms

Yes

Yes

Form/Rate Filing & Binder

Checklist for Individual and Small Group Medical Plans – Network

Adequacy

Yes

Yes

Binder only

MI Uniform Modification Justification Form

Yes

Yes

Form/Rate Filing & Binder

Network Adequacy Justification, as applicable

Yes

Yes

Binder only

ECP Justification, as applicable

Yes

No

Binder only

Filing Deadlines

Small Group 5/15/2024

Individual 5/29/2024

NOTE: All required templates must be completed and, if applicable, validated before uploading to SERFF. Use of PY24 QHP Application Review Tools

including the Data Integrity Tool is required for the initial template submission and any subsequent submission. All template revisions must be uploaded to

the same locations as originally filed (i.e., SERFF Form/Rate Filing, Binder or BOTH)

[15]

Exhibit 2 – RATES and AV

PY25 Medical Plans Filing Requirements

Requires Submission Via SERFF

Federal Required Templates

On- and On-/-Off-

Marketplace

Off-Marketplace

SERFF Location

Part I: Unified Rate Review (URRT)

Yes

Yes

Form/Rate Filing URRT

Tab & Binder

Part II: Written Description Justifying

the Rate Increase*

Yes, for plans that

exceed the federal

rate review threshold

Yes, for plans that exceed the

federal rate review threshold

Form/Rate Filing URRT

Tab

Part III: Actuarial Memorandum

Yes

Yes

Form/Rate Filing URRT

Tab & Binder

Rates Table

Yes

Yes

Form/Rate Filing & Binder

Unique Plan Design—Supporting

Documentation

and Justification**

Yes – as applicable

under 45 CFR

156.135(b)

Yes – as applicable under 45

CFR 156.135(b)

Form/Rate Filing & Binder

Screenshots of the AVC***

Yes – for all plans

with a unique plan

design

Yes – for all plans with a

unique plan design

Form/Rate Filing & Binder

Michigan Supplemental Health Care

Exhibit

Yes

Yes

Form/Rate Filing & Binder

Checklist for Individual and Small

Group Medical Plans-Rates

Yes

Yes

Form/Rate Filing & Binder

Filing Deadlines

Small Group 05/15/2024

Individual 5/29/2024

*Subject to final CMS notification

**All blended cost sharing amounts and/or adjustments and the development allowed under 45 CFR 156.135(b)(2) and/or 45 CFR 156.135(b)(3) must be submitted with the Unique Plan

Design- Supporting Documentation and Justification form.

*** Screenshots of the AVC must be provided for all plans with a unique plan design including CSR variants for On-Marketplace Silver plans.