Internal Control

over Financial

Reporting (ICFR)

Driving governance through effective

nancial reporting

Table of

Contents

01

05

02

06

03

07

04

Executive Summary - The vision for ICFR

ICFR and its regulatory regime

Understanding ICFR stakeholder’s expectations and respon-

sibilities

ICFR Maturity Landscape

PwC’s FOCUSED approach

Case Studies

Contacts

Executive Summary

The vision for ICFR

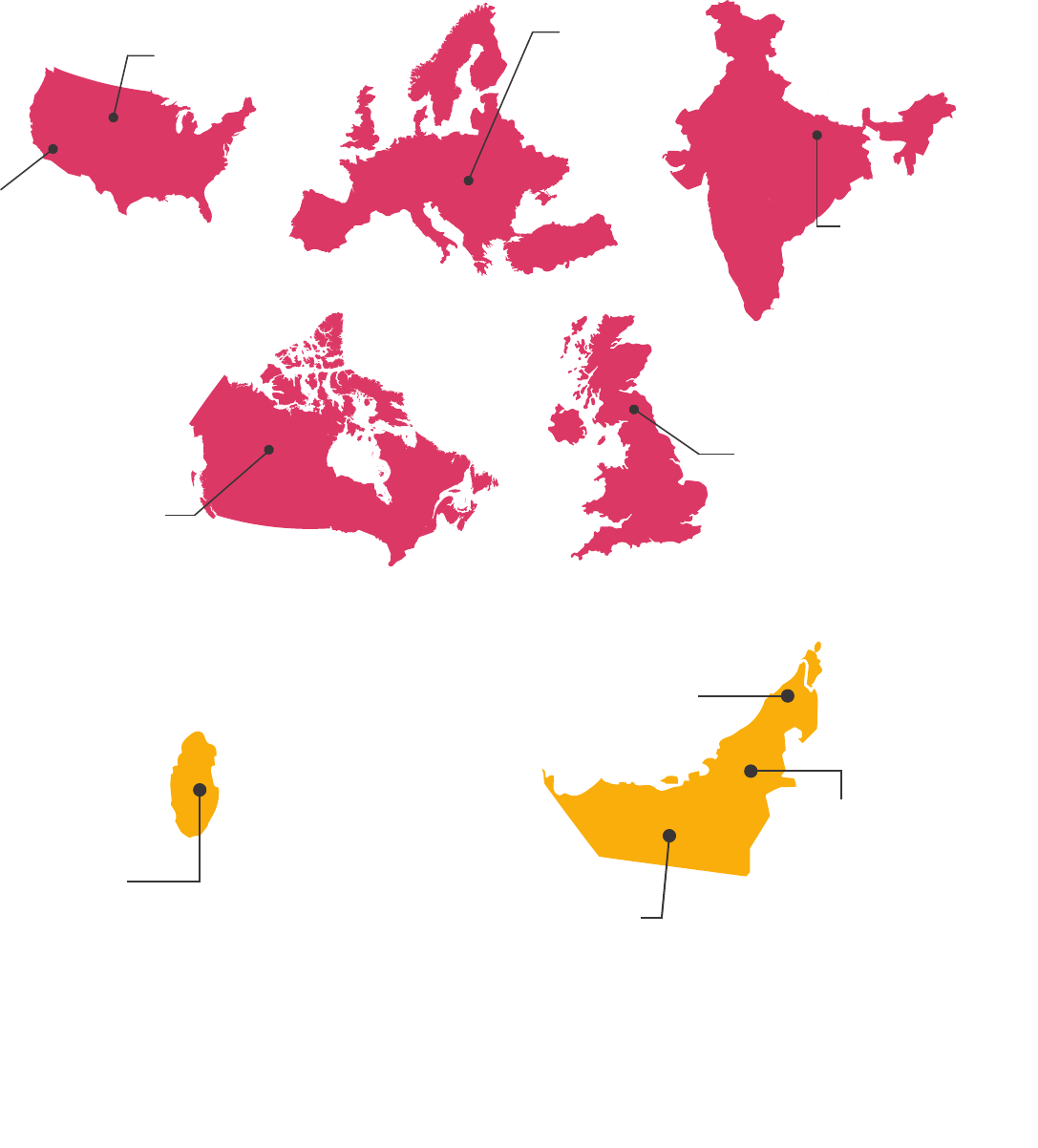

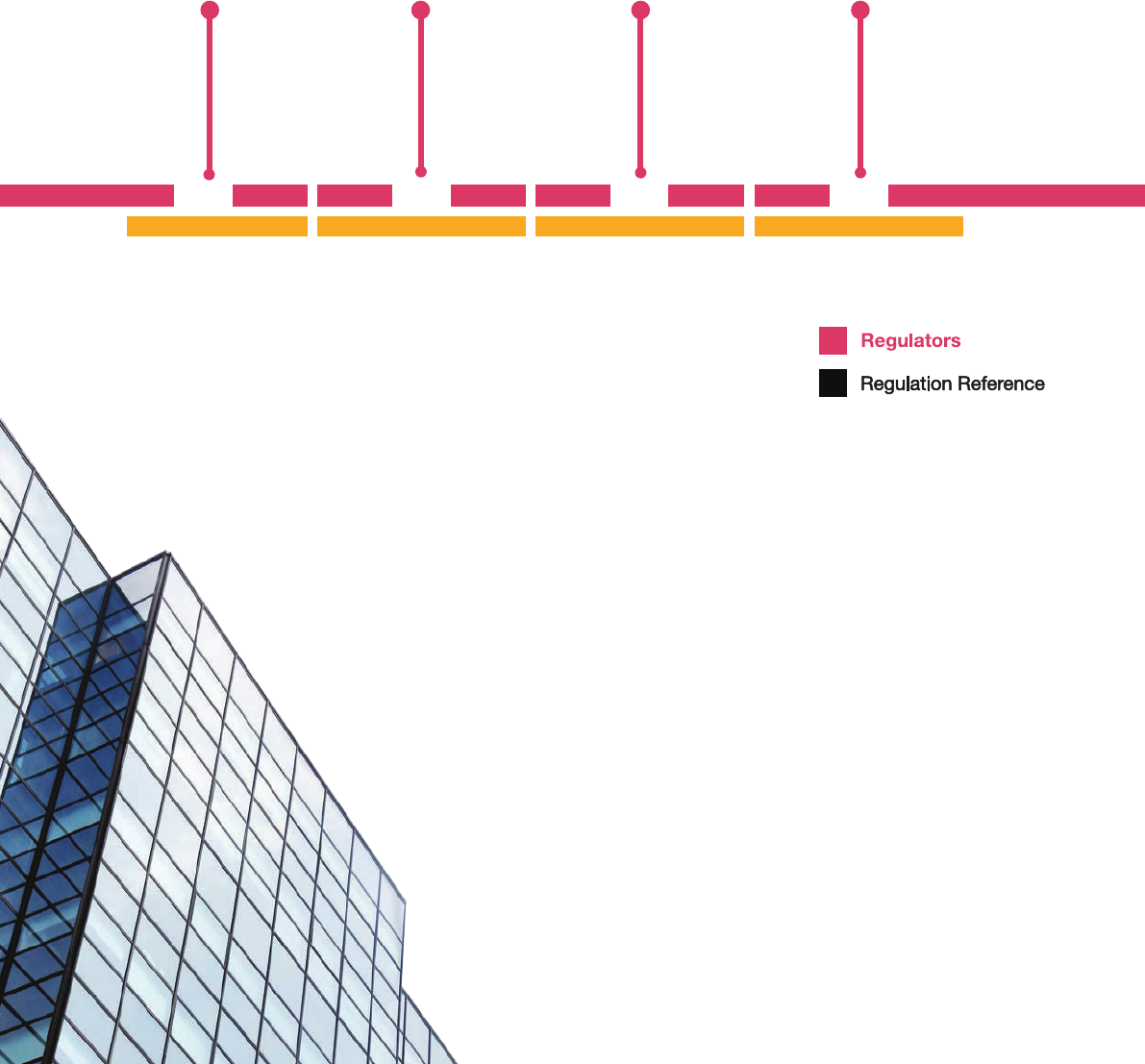

The Securities &

Exchange Commission

(SEC) - USA

Canadian

Securities

Administrators

(CSA) - Canada

Registrar of

Companies -

India

The Council

of European

Union -

Europe

Financial

Reporting

Council (FRC)

- UK

Public

Company

Accounting

Oversight Board

(PCAOB) - USA

The current landscape for ICFR

The Internal Control over Financial Reporting (ICFR) remains an essential part of the Chief Financial Ofcer (CFO)

agenda in order to ensure that the information reported in the nancial statements is accurate and does not contain

any material misstatement.

The Internal Control and nancial reporting disciplines have evolved signicantly over past two decades due to

various international business incidents including the Enron collapse, global nancial crisis, oil price volatility, amongst

other events. This has resulted in major regulatory reforms that aims for governing the internal control environment,

especially focused towards the nancial reporting. Many international and regional regulators have since implemented

various laws, regulations and guidelines in relation to ICFR, a few of which are listed below:

International

Regional

Abu Dhabi

Accountability

Authority

(ADAA) - UAE

Securities and

Commodities Authority

(SCA) - UAE

Insurance

Authority - UAE

Qatar Financial

Markets Authority

(QFMA) - Qatar

Over more recent years, the Middle East region has unfortunately witnessed some organisational crises within

various sectors including healthcare, private equity, nancial services and construction. This, paired with the overall

increase of business challenges due to COVID-19 situation, have raised concerns from the following key stakeholders

on the quality of ICFR. In this paper, we have captured the expectations of these stakeholders as well as their key

responsibilities.

Internal External

• Boards

• Audit Committees

• Senior Management

• Finance Department

• Audit department

• Regulators

• Shareholders / Owners

• Investors

• Creditors

• Statutory Auditors

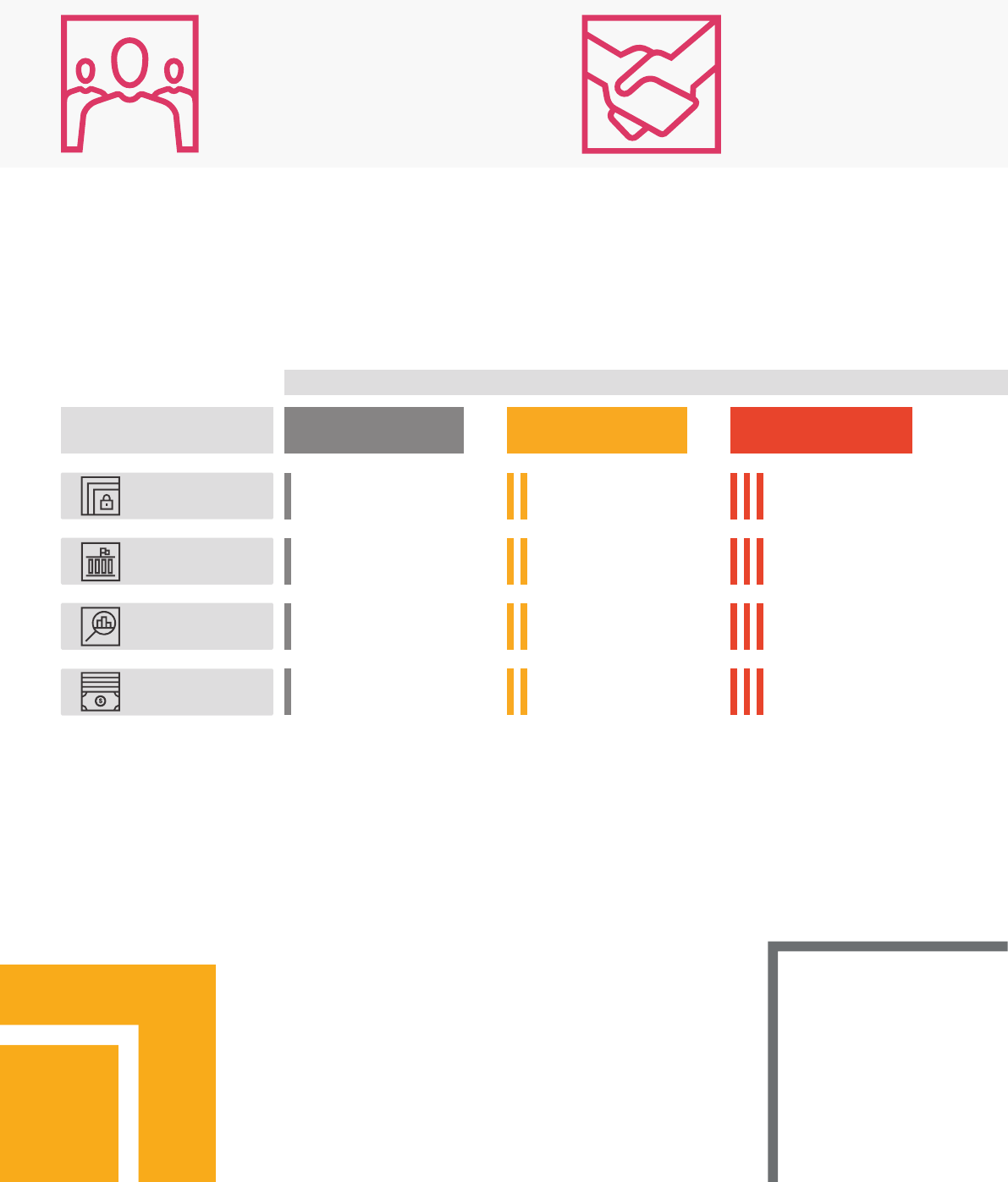

Extracting maximum value from ICFR investment

The value an organisation extracts from ICFR exercise depends on various factors, including the size, operations,

accounting framework, complexities, internal control team, governance, and culture of the business. The below “PwC

Maturity Landscape” not only helps organisations to assess their maturity level in ICFR domain but also helps them in

getting the maximum value from the investment in ICFR agenda.

Level 1 - Regulatory

Compliance

Maturity Level

Maturity Dimensions

Role Clarity

Unclear Informal Formal

Defensive Responsive Collaborative

Intermediate Advanced

Beginner

Governance

Culture

Data Analytics

Efciency focus Value focusCost focus

Value

Level 2 - Controls

Insights

Level 3 - Value

Enhancement

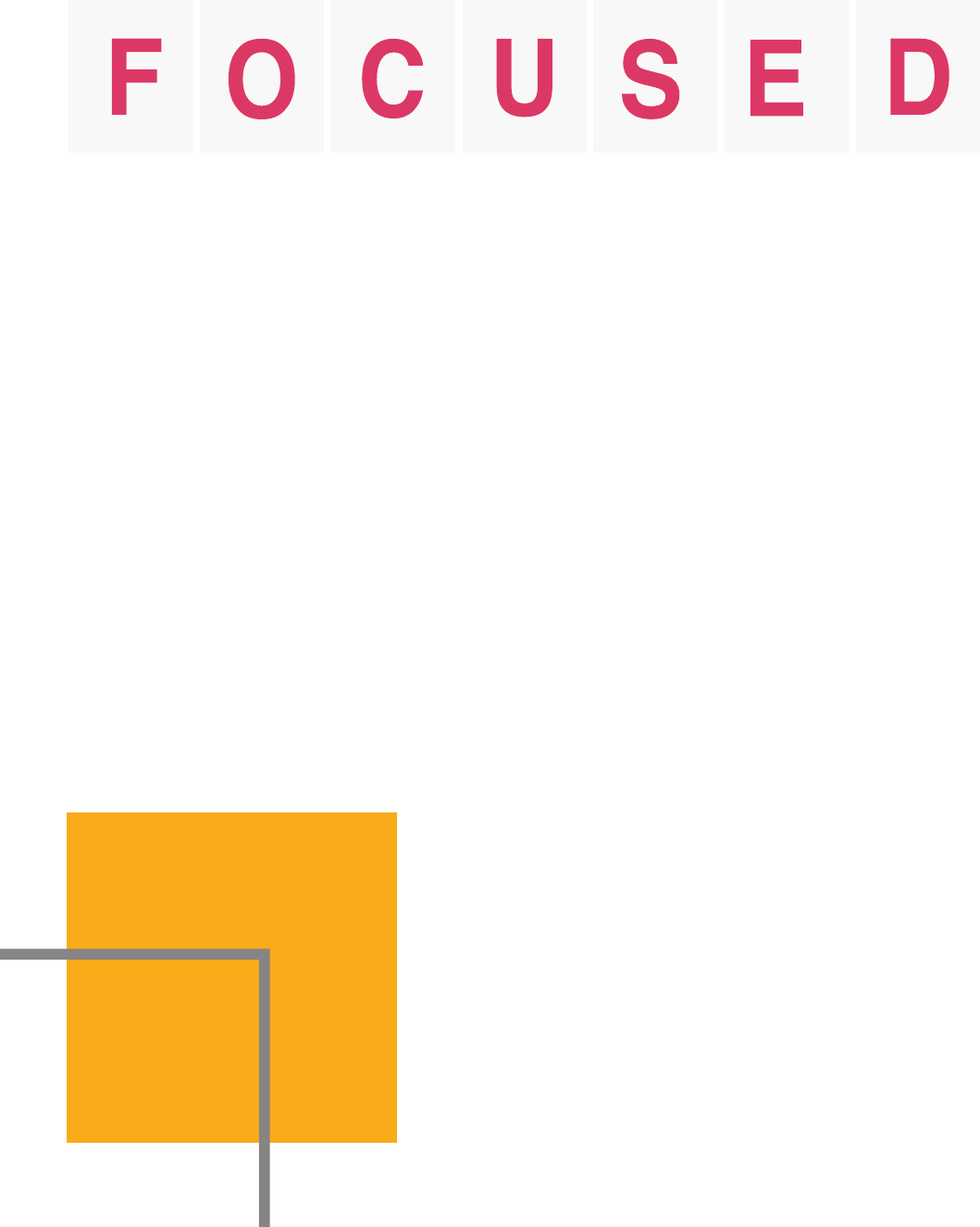

Rethinking ICFR to help you stay “FOCUSED” and achieve

resilience

At PwC we have recognised how important ICFR is for the Middle East region in terms of scope, maturity landscape,

reporting and digital upskilling, when compared with the rest of the world. Therefore, we have analysed international

leading practices and considered Middle East business practices to develop our bespoke “FOCUSED” approach.

Framework

development

Operational

assessment

Control design

review

Upgrading

internal

practice

Sampling

techniques

Documentation

and representation

Effectiveness

testing

The FOCUSED approach, extends beyond just achieving regulatory compliance is based on international leading

practices, internal control frameworks (COSO, SOX etc.) and lessons learned from advanced economies tailored to

the specic requirements of organisations in the Middle East region operating in various sectors. At PwC we leverage

from FOCUSED approach to help organization in their ICFR maturity journey and get maximum value from it. A

couple of case studies are added in the later part of this paper.

Introducing the

importance of ICFR

How does ICFR make a difference in the

nancial reporting world?

Dening ICFR: In simple terms, ICFR means a process which is implemented by those charged with governance

and management to provide reasonable assurance that a mechanism of Internal Control is in place to achieve the

following objectives:

The nancial statements are prepared as per the applicable nancial reporting framework e.g.

IFRS, local GAAPs e.g. IPSAS, SOCPA

The transactions and events reported

in the nancial statements are duly authorised as per the protocols implemented by management and

those charged with governance.

A process is in place to prevent or timely detect and amend any unauthorized use of assets /

resources employed by the organisation.

The organisation maintains accurate

records / evidence to back all transactions which are reported in a nancial period.

International Regulatory Regime on ICFR to achieve

resilience

Internal Control are often an area of focus for investors, creditors, shareholders and Board members, among other

stakeholders, when ensuring that the organisation provides accurate nancial reporting which shows its state of

operations in today’s constantly changing business environment.

However, the ICFR agenda became more critical with situations such as those raised in 2002 (Enron), 2008 (global

nancial crisis), and 2016 (oil price slump) etc. Each of these historical business world challenges brought key

stakeholders (regulators, investors, creditors etc.) together to better legislate reporting protocols and introduce new

practices to assess the risks facing the businesses and having sound Internal Control to mitigate those risks. In this

regard many initiatives were taken by regulators across the globe to implement an ICFR agenda, such as the below:

The introduction of Middle East regulatory initiatives

In recent years, the collapse of many Middle East businesses in the private equity domain, nancial services,

healthcare and construction sectors has raised many concerns among the stakeholder community. The year 2020

brought another major challenge with the unforeseen COVID-19 pandemic, which created even more pressure on the

business world.

In this situation many regulators have taken initiatives to further strengthen the Internal Control environment especially

around the nancial reporting domain. The regulations mentioned in the below table are a few examples where subject

entities are required to implement an ICFR framework. At present, many other regulators in the region are exploring

this agenda to better manage nancial reporting.

2016

2016

Qatar UAE

Qatar Financial

Markets

Authority

(QMFA) - Qatar

Securities and

Commodities

Authority (SCA)

- UAE

Abu Dhabi

Accountability

Authority

(ADAA) - UAE

Insurance

Authority -

UAE

Article 8 of

Governance code

for companies and

legal entities listed

on the main market.

Article 50 of Resolution

No. (7 R.M) of 2016

Article 4 of ADAA

Resolution 1 of 2017

Circular no. 21 of 2019

2017 2019

UAE UAE

Controls survey

PwC 2020 Internal

of the respondents perceive Internal Control

as valuable but feel that not all levels in the

organisation are proactively participating in the

internal control journey

Almost 60% of the respondents declared that

they do not have a specic governance, risk

management and compliance system for managing

Internal Control

76%

60%

expectations and

responsibilities

stakeholder’s

Understanding ICFR

ICFR agenda allows organisations to work collaboratively as a single unit and ensure that the operations are

accurately translated into gures which are reported in the nancial statements. As many stakeholders have different

expectations on this agenda, there are certain responsibilities which are expected from them to implement an effective

ICFR model.

External Stakeholders

Regulators

Investors & Creditors

Shareholders

Statutory Auditors

ICFR expectations

Adopt an internationally acclaimed internal control framework.

ICFR expectations

The nancial statements provide accurate information about the organisation’s state of affairs.

ICFR expectations

Accurate nancial reporting through deployment of sound Internal Control.

ICFR expectations

Management should adopt and effectively implement an ICFR framework.

Responsibilities

Develop a monitoring mechanism to assess the effective implementation across regulated

organisations.

Responsibilities

Encourage organisations to provide ICFR audit opinions.

Responsibilities

Encourage the culture of leading practices around Internal Control and governance.

Responsibilities

Perform independent assessment of management ICFR practices..

Internal Stakeholders

Board / Audit Committees

Senior Management - CEO / CFO

Process Owners

Internal Control (IC) Team under (Finance / Risk Management)

Internal Audit

ICFR expectations

The nancial statements prepared by management is based on effective ICFR framework.

ICFR expectations

Receive required budget approvals from Board / AC and authority to implement effective

ICFR practices.

ICFR expectations

Obtain required guidance from the IC team in understanding nancial reporting controls and

their role in managing it.

ICFR expectations

Obtain due support from senior management in terms of resources, skill set, training and

governance.

ICFR expectations

Involve in discussion with the IC team where any specic input is required on critical or

complex controls.

Responsibilities

Approve required budgets, policies, procedures etc. associated with ICFR.

Responsibilities

Sign off organisation’s conformance with effective ICFR practices and endorsing it for Board /

AC approval.

Responsibilities

Exercise the compliance with organisation’s internal control practices during day to

day operations.

Responsibilities

Lead the ICFR mandate in the organisation to ensure controls are adequately

designed and operating effectively.

Responsibilities

Provide advisory support to the nance department in effective implementation of ICFR.

Landscape

ICFR Maturity

The value a company can extract by implementing ICFR is highly dependent on the maturity level of the organisation

from ICFR perspective. Based on the international leading practices, we have developed a four dimensions of ICFR

maturity landscape which provide a basis to assess at which level your organisation sits among the three maturity

levels:

Organisations consider ICFR as a regulatory burden and mainly focus to comply with regulatory

requirements.

Organisations take ICFR as an opportunity to bring processes efciencies through control optimization,

eliminate redundant / duplicate controls and extend control automation.

Organisations focus more on controls issues related to new projects / ventures whereas existing

critical controls get monitored through continuous monitoring tools.

Maturity Level 1: Regulatory Compliance

Maturity Level 2: Process Efciencies

Maturity Level 3: Value Enhancement

Role clarity

Role clarity

Role clarity

Value

Value

Value

Governance

Culture

Governance

Culture

Governance

Culture

Data Analytics

Data Analytics

Data Analytics

Unclear: Lack of clarity

on the overall roles

and responsibilities in

relation to ICFR project

among nance and other

departments.

Informal: The Internal

Control Team leads the

ICFR exercise while

educating other process

owners to play the required

role.

Formalised: The user

departments clearly

understand their role and

proactively manage control

agenda with oversight

support from the Internal

Control Team.

Defensive: Highlighting

Internal Control failures are

discouraged in a fear to get

a qualied opinion from the

statutory auditors.

Responsive: Each

stakeholder is encouraged

to highlight any control

deciency to put

remediations on a timely

basis.

Collaborative: Control

failures are corrected

on a real-time basis by

collaboration across

functions and are taken as

an opportunity to improve

internal practices

Beginner: Internal Control

are tested on conventional

sample testing basis

with review of limited

transactions, without use

of any digital tools or data

analysis.

Intermediate: Various data

tools are used to analyze

the whole population for

targeted sample testing.

Advanced: Continuous

monitoring tools are used to

monitor controls on a real-

time basis and focus more

on value-added areas.

Cost Focus: ICFR exercise

is considered as a cost

center with a perception of

minimum value addition to

comply with regulations.

Efciency Focus: ICFR

exercise is considered

as a business process

re-engineering project to

eliminate duplication and

introduce efciencies.

Value Focus: ICFR

exercise is taken as an

opportunity to enhance

value by introducing leading

practices in the existing

control environment.

benchmarking survey

PwC 2019 ICFR

of the company do not have a process for

scoping to identify to which extent and level

the ICFR framework is applied.

of the company do not apply digital

tools to support the ICFR process

41%

60%

approach can help

the ICFR journey

How PwC’s FOCUSED

your organisation in

The success of an ICFR exercise highly depends on the way it is planned, executed and monitored. An ICFR exercise

complying with all requirements may not be able to highlight key control design or operating failures if a correct

approach is not used. Therefore, based on the leading practices in the regulated economies along with the specic

business needs of the Middle East region, PwC has developed its ICFR-centric approach “FOCUSED” that addresses

all of the key pain points for organisations of any size and support them in the ICFR maturity journey.

F

C

U

S

E

D

O

ramework Development

perations Assessment

ampling Techniques

ocumentation and Representation

ffectiveness Testing

ontrol Design Review

pgrading Internal Practices

brings an effective governance

culture and provides role clarity

by developing entity specic ICFR

framework based on nancial

reporting standards and leading

control practices.

assesses company’s operations and

provides value centric mechanism

to identify process universe,

reporting risks and their mapping

with nancial statements.

leverages from various walk-through,

data analytics and control dynamic

techniques to assess design

adequacy of existing controls related

to nancial reporting.

Based on the control design gaps,

this phase brings value to business

through re-engineering existing

processes and introducing leading

digital practices to strengthen control

design.

deploys various data driven sampling

methodologies to select the right

value centric approach to get wider

insights and assurance on target

population.

use a mix of Data Analytics and

conventional testing techniques to

ensure that transactions executed

during the period comply with

nancial reporting requirements.

remains active throughout ICFR

life cycle and provides an effective

governance culture identifying

clear roles, timelines, templates etc.

requirements.

At PwC, we leverage the FOCUSED

approach to help organisations in

their maturity journey. Our tools,

techniques and team members are

well versed with ICFR requirements

and comfortably diagnose the maturity

level of an organisation as well as the

dimension which require more focus.

Case Studies

We have listed below a couple of examples where we partnered with some organisations in the Middle East region

while leveraging our FOCUSED approach and helping them in various dimensions of ICFR maturity landscape:

The client was involved in issuing

multiple sets of nancial statements on

two different accounting frameworks. The

ICFR agenda was implemented a few

years ago, however the management

was not condent that all key risks / gaps

were identied and addressed.

The client managed a portfolio of more

than 100+ subsidiaries, associates, joint

ventures, etc. The parent was required

to issue ICFR opinion on individual as

well on group level nancial statements.

However, there was no precedent

in the region to manage a similar

ICFR mandate especially with such a

diversied portfolio and the complex

nature of group entities (listed, private,

foreign, greeneld projects, etc.).

Through deploying the FOCUSED approach, the PwC

team employed various data analytical tools to re-analyze

the scoping model. The work helped to identify multiple

areas which were not considered in the previous ICFR

exercises. This identication not only helped to enhance

nance department oversight on those processes

but also helped management to x numerous gaps

which could result in material errors in overall nancial

reporting.

Through deploying the FOCUSED approach PwC

team developed a group tailored ICFR framework

which provided synergies through optimising design

and effectiveness testing process. In addition, the PwC

team performed a comprehensive analysis over group

structure and proposed a data model which classies

entities based on multiple risk factors. This data model

helped the group in objectively identifying high risk

entities and steer the efforts towards the most important

controls.

Client Industry and Region: Energy Sector | Middle East Region

Client Industry and Region: Government Funded Investment Conglomerate |

Middle East Region

Client Situation

Client Situation

How PwC supported the client to resolve the issue

How PwC supported the client to resolve the issue

Contacts

About PwC

At PwC, our purpose is to build trust in society and solve important problems. We’re a network of rms in 155 countries with over

284,000 people who are committed to delivering quality in assurance, advisory and tax services. Find out more and tell us what

matters to you by visiting us at www.pwc.com.

Established in the Middle East for 40 years, PwC has 22 ofces across 12 countries in the region with around 6,000 people. (www.

pwc.com/me).

PwC refers to the PwC network and/or one or more of its member rms, each of which is a separate legal entity. Please see www.

pwc.com/structure for further details.

© 2021 PwC. All rights reserved

Adnan Zaidi

Middle East Assurance

Clients & Markets Leader

T: + 971 56 682 0630

John Saeed

Middle East Internal Audit

& GRC Leader

T: +966 56 007 9699