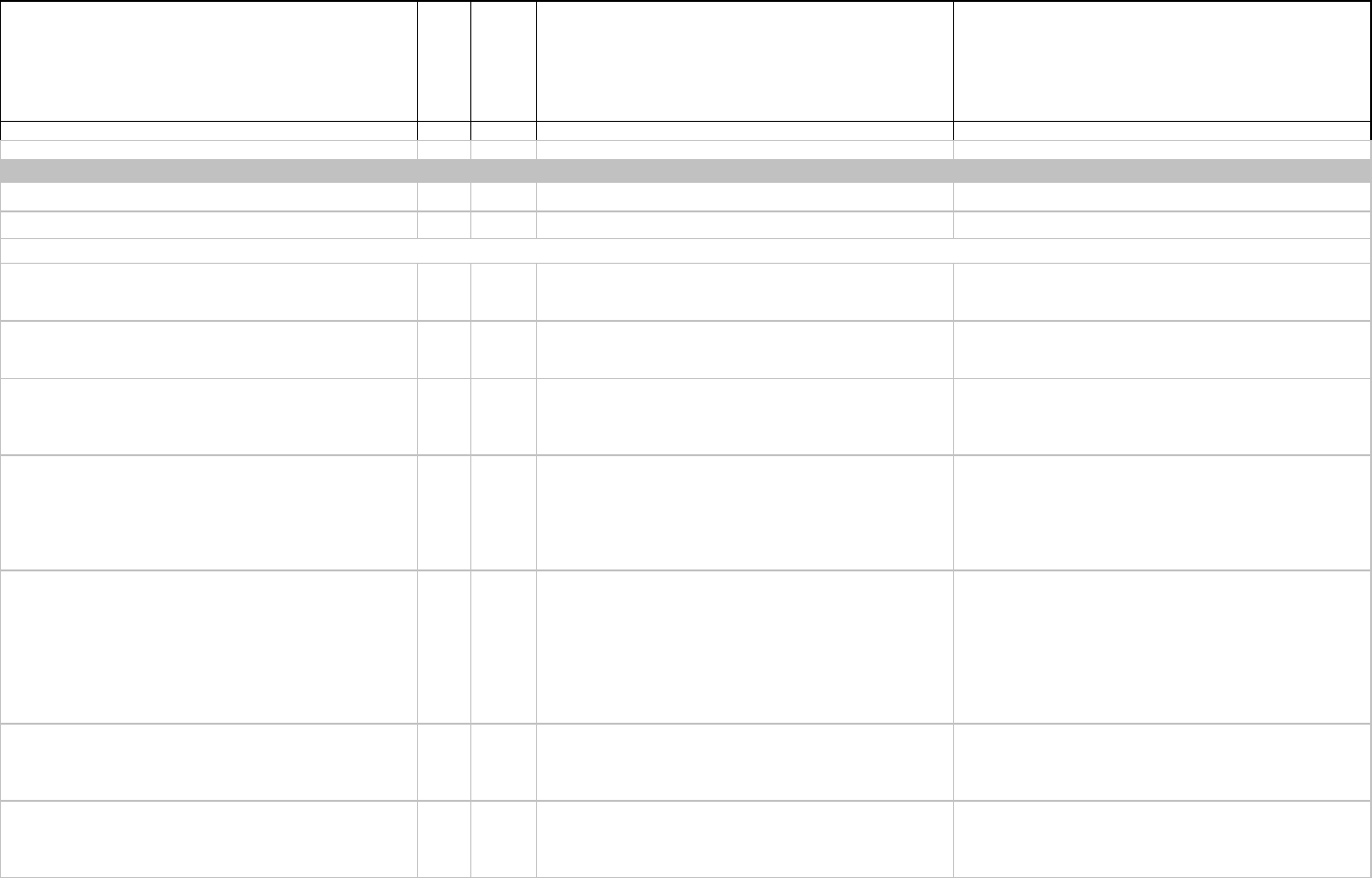

Unit:

Subject: Sarbanes-Oxley Act Review - Financial Reporting

Title: Risk & Control Identification

Year end:

OBJECTIVE

OBJECTIVE

CATEGORY

RISK

REFERENCE

POTENTIAL RISK

SUGGESTED CONTROLS TO MITIGATE THE POTENTIAL

RISK (Internal Audit)

ACCOUNTING POLICIES AND PROCEDURES

Management should define and communicate accounting

principles. Accounting policies and procedures should be

established in accordance with management criteria, GAAP,

and applicable laws and regulations. These policies and

procedures should be in writing and provide adequate

explanations for the company's accounting policies and

procedures.

FIN101

Financial statements / Management pack may be misstated,

inconsistent, and / or not prepared in accordance with

Management policies, GAAP and applicable laws and

regulations.

Written accounting policies and procedures exist and include

such matters as:

Chart of accounts accompanied by explanations of the items to

be included in the various accounts.

Identification and description of the principal accounting

records, recurring standard entries, and requirements for

supporting documentation. For example, this may include

information about the General Ledger, source journals,

subsidiary ledgers, and detail records for each significant class

of transactions.

Expression of the assignment of responsibilities and delegation

of authority, including identification of the individual positions

that have authority to approve various types of recurring and

non-recurring entries.

Explanations of documentation and approval requirements for

various types of recurring and non-recurring transactions and

journal entries. Documentation requirements, for example,

would include the basis and supporting computations required

for adjustments and write-offs.

Instructions for determining an adequate cut-off and closing of

accounts for each reporting period.

Appropriate revision of policies and procedures.

FIN102

Accounting policies and procedures are no longer pertinent. Accounting policy and procedure manuals are updated as

necessary. New policies and procedures or changes to

existing policies and procedures or changes to existing policies

and procedures should be documented, reviewed and approved

by management.

OBJECTIVE

OBJECTIVE

CATEGORY

RISK

REFERENCE

POTENTIAL RISK

SUGGESTED CONTROLS TO MITIGATE THE POTENTIAL

RISK (Internal Audit)

Only authorised persons can alter or establish a new

accounting principle, policy, or procedure to be used by the

company.

FIN103

Unauthorised accounting principles may be applied. The Board of Directors approves accounting principles to be

applied.

CODING AND CLASSIFICATION OF TRANSACTIONS

All reportable transactions and activities should be coded and

classified on an accurate and consistent basis, and in

accordance with company policy, GAAP, and applicable laws

and regulations.

FIN201

Inaccurate coding and classification of regulated and non-

regulated activities may occur. Misallocations between General

Ledger accounts, Cost Elements, or Cost Centres. Financial

statements may be misstated, inconsistent, and / or not

prepared in accordance with company policy, GAAP, and

applicable laws and regulations.

Reference manuals and guides which describe and define

codes and accounts should be maintained and distributed (e.g.

an Accounts Manual).

Employees should be trained on the use of proper codes.

New codes should be systematically assigned and existing

codes should be updated as appropriate.

Documents used to report transactions and activities (e.g. time

sheets, vouchers) should be reviewed and approved by

management.

Transactions or changes impacting the financial reporting

process should be reported to Corporate Accounting e.g. all

new clearing accounts, extraordinary items, prior period

adjustments, and contingent liabilities.

GENERAL LEDGER MASTER RECORDS (CHART OF ACCOUNTS)

General Ledger Master Data / General Ledger Maintenance

OBJECTIVE

OBJECTIVE

CATEGORY

RISK

REFERENCE

POTENTIAL RISK

SUGGESTED CONTROLS TO MITIGATE THE POTENTIAL

RISK (Internal Audit)

Only valid changes are made to the General Ledger master

records. (validity) The General Ledger Chart of Accounts

reflects Group requirements. New accounts will be added to

the Chart of Accounts only if they are necessary and have been

approved to help ensure efficient system processing and

accurate transaction processing.

FIN301

Invalid changes are made to the General Ledger master

records.

A procedure is established that changes to the General Ledger

master record are documented on a valid source document and

approved by Senior Management. All information entered

during General Ledger master record creation and / or change

is automatically validated by SAP. Upon entry in the field, the

system automatically checks the value entered against the

values available in the configuration tables. An error message

is generated if the value entered is not available. Standard SAP

functionality prevents General Ledger accounts from being

deleted until accounts are void of all activity. General Ledger

accounts cannot be marked for deletion until they have been

blocked from posting for a specified length of time, (e.g. end of

fiscal year). Procedures are established for the official

responsible for the creation of new General Ledger accounts to

perform a matchcode search when creating a new General

Ledger account to ensure that General Ledger accounts do not

proliferate. Searches can be performed on the following codes:

Chart of Accounts; General Ledger Account #, General Ledger text & company.

All valid changes to General Ledger master records are

processed. (

completeness)

FIN302

Not all valid changes to the General Ledger master records are

input and processed.

Requests to change General Ledger master records are

submitted on standard prenumbered forms (e.g. a "General

Ledger master record form"). To ensure that all request

changes are processed , the numerical sequence of such

forms is accounted for after processing (e.g. by reconciliation

to a SAP report of General Ledger master record changes e.g.

RFSABL00 - change documents).

Changes to the General Ledger master records / Chart of

Accounts will be communicated to the user community in a

timely manner to prevent processing errors.

FIN303

System interruptions. Misallocations.

A list of users affected by the changes made to General Ledger

master records should be maintained. Before performing a

change, the official making the change should notify and verify

the change with all these users to ensure that the change will

be properly implemented without causing system interruption.

General Ledger master record information is recorded in a

consistent and complete fashion.

FIN304

Incomplete data may be entered in the General Ledger master

records. Critical fields that must be entered are not specified as

mandatory.

The field status group defines the fields that are mandatory and

optional when using the General Ledger account.

OBJECTIVE

OBJECTIVE

CATEGORY

RISK

REFERENCE

POTENTIAL RISK

SUGGESTED CONTROLS TO MITIGATE THE POTENTIAL

RISK (Internal Audit)

Changes to General Ledger master records are correctly

processed. (

accuracy)

FIN305

Changes to General Ledger master records may be incorrectly

processed.

The official (responsible for maintenance of General Ledger

master records) shall process all requests for modification of

the General Ledger master records after having checked the

contents and the accuracy of the data supplied. Each change

to General Ledger master records is prepared from appropriate

source documents (e.g. a "General Ledger master record

amendment form"). SAP edits and validates General Ledger

master records online, identified errors are corrected promptly.

Notifications of changes to General Ledger master records are

processed timeously. (

proper period) All new accounts will be

added in a timely manner so they are available for transaction

processing in the correct period.

FIN306

Changes to the General Ledger master records are not

processed timeously. Payroll may be incorrectly computed for

the relevant period.

A procedure should be established that the change to General

Ledger master records is made within an established time

period after the source document (e.g.: General Ledger master

record amendment form) has been received. By processing the

change immediately after the source document has been

received, the General Ledger master record is kept current and

the possibility of incorrect changes being made is minimised.

Requests to change General Ledger master record data are

logged. The log is reviewed to ensure that all request changes

are processed timeously.

Changes to General Ledger master records are authorised by a

responsible official. (authorisation

) Maintenance to the Chart of

Accounts will be properly approved to ensure that the changes

will be properly implemented.

FIN307

Changes to General Ledger master records may not be

authorised.

Significant changes to General Ledger master records are

approved by management.

General Ledger master records remain pertinent. Maintenance

of the Chart of Accounts will be conducted for operating

efficiency. General Ledger master records are periodically

checked by a responsible official (for inter alia completeness

and accuracy).

FIN308

General Ledger master records do not remain pertinent.

General Ledger master records) may not be properly

maintained. General Ledger master records no longer needed

are not deleted / archived from the system.

General Ledger master record data is periodically reviewed by

management for accuracy and ongoing pertinence.

Management review the Chart of Accounts annually to identify

unused, duplicates, or possible additions to the values.

An audit trail will exist for all changes to the Chart of Accounts.

All changes to, and deletion of General Ledger master records

must be properly logged, documented and retained.

FIN309

Unauthorised changes to General Ledger master records

(including creation or deletion of accounts) may go undetected.

Errors in capturing General Ledger master records are not

timeously identified. No responsibility is assigned for regularly

reviewing audit trails of change information. (No master data

amendment report is generated to ensure that the information

processed is correct and accurate.) Changes to General

Ledger master records are not supported by valid

documentation. Required documentation is not retained for

mandatory retention periods.

The Financial Accountant reviews the General Ledger account

change report on a monthly basis to ensure changes are

performed in compliance with General Ledger maintenance

requests. Changes to critical General Ledger master details are

reviewed by senior management. A master data amendment

report showing data before and after changes is approved

(based on a comparison to source documents where

appropriate) by an independent person. A SAP report (e.g.

RFSABL00) is generated with date and time of change, old and

new values for fields and also the user who entered the

change. Procedures exist to retain all documentation on any

Chart of Accounts maintenance requests.

OBJECTIVE

OBJECTIVE

CATEGORY

RISK

REFERENCE

POTENTIAL RISK

SUGGESTED CONTROLS TO MITIGATE THE POTENTIAL

RISK (Internal Audit)

GENERAL LEDGER ENTRIES

General Ledger Posting: Recording of entries in the General Ledger from cashbook, sales, accounts payable and other subsidiary systems.

General Ledger entries are prepared with genuine information.

(

validity) The authenticity of the transaction source is validated.

FIN401

Transaction may not be genuine.

Rejected items require re-entry on a timely basis subject to the

same input controls as new transactions. (completeness)

FIN402

Rejected items not re-entered. All rejected items should be reviewed for errors and re-entered

in the same manner under management supervision.

Application systems provide audit trails of significant

transaction activity.

FIN403

Historical General Ledger detail, including supporting

documentation is not available when needed. No audit trail,

resulting in fraud and errors not being identified or corrected.

Standard SAP functionality tracks all transactions and access

to the system is restricted. Review and approval of audit trail

reports on a timely basis.

All General Ledger entries are recorded. (completeness)

Application controls ensure all transactions input are

processed.

FIN404

Not all valid transactions are processed.

Recurring entries: Some financial documents have to be posted

every month to the General Ledger. SAP has the recurring

entries option available where documents are entered only once

in the system and SAP is told when to process the document

again automatically. Reconciliation of General Ledger

accounts.

General Ledger entries are correct in respect of amounts

(

accuracy).

FIN405

Transactions processed are inaccurate. Field status groups define the fields that are mandatory and

optional when using the General Ledger account during

processing. The field status groups were configured during

implementation and help to ensure the accurate entry of

financial postings. Financial documents are automatically

checked during entry to ensure that debit and credit balance.

Creation of the document is only possible after the error has

been corrected.

Foreign exchange gains and losses are calculated correctly and

posted to the correct account.

FIN406

VAT, sales tax (Usutu?) and foreign exchange gains and

losses are calculated incorrectly or posted to the incorrect

account.

SAP can be configured per company and per foreign currency

how much the exchange rate on the document header may

differ from the exchange rate currently known in the system.

General Ledger entries are posted to the correct account.

(

classification)

FIN407

Items are matched to the incorrect open item managed account

or to the incorrect line item in an open item managed account.

Financials are inaccurate and are not comparable due to

misclassifications.

SAP is configured to establish account assignment models to

reduce data entry errors. Financial document types define the

type of account that a document can be posted to.

Reconciliation of General Ledger accounts.