NBER WORKING PAPER SERIES

COMMUNICATION AND BARGAINING BREAKDOWN:

AN EMPIRICAL ANALYSIS

Matthew Backus

Thomas Blake

Jett Pettus

Steven Tadelis

Working Paper 27984

http://www.nber.org/papers/w27984

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

October 2020

We are grateful to numerous seminar and conference participants, as well as to Charles

Angelucci, Anne Bartel, Wouter Dessein, Liran Einav, Sarah Moshary, Michaela Pagel, Andrea

Prat, and especially Jonah Rockoff for thoughtful comments, as well as many eBay employees for

their input and support, and finally Brenden Eum and Alphonse Simon for excellent research

assistance; all remaining errors are our own. Part of this research was supported by NSF Grant

SES-1629060. Matt Backus has in the past been a paid consulting researcher for eBay Inc. The

views expressed herein are those of the authors and do not necessarily reflect the views of their

employers, eBay, or the National Bureau of Economic Research.

NBER working papers are circulated for discussion and comment purposes. They have not been

peer-reviewed or been subject to the review by the NBER Board of Directors that accompanies

official NBER publications.

© 2020 by Matthew Backus, Thomas Blake, Jett Pettus, and Steven Tadelis. All rights reserved.

Short sections of text, not to exceed two paragraphs, may be quoted without explicit permission

provided that full credit, including © notice, is given to the source.

Communication and Bargaining Breakdown: An Empirical Analysis

Matthew Backus, Thomas Blake, Jett Pettus, and Steven Tadelis

NBER Working Paper No. 27984

October 2020

JEL No. C78,D82,D83,M21

ABSTRACT

Bargaining breakdown—whether as delay, conflict, or missing trade—plagues bargaining in

environments with incomplete information. Can a bargaining environment that facilitates or

restricts communication alleviate these costs? We exploit a unique opportunity to study this

question using real market transactions: eBay Germany’s Best Offer platform. On May 23, 2016,

the platform introduced unstructured communication allowing buyers and sellers on the desktop

version of the site, but not the mobile app, to accompany price offers with a message. Using this

natural experiment, our difference-in-differences approach documents a 14% decrease in the the

rate of breakdown among compliers. Though adoption is immediate, the effect is not. We show,

using text analysis, that the dynamics are consistent with repeat players learning how to use

communication in bargaining, and that the messaging strategies of experienced sellers are

correlated with successful bargaining.

Matthew Backus

Graduate School of Business

Columbia University

3022 Broadway, Uris Hall 619

New York, NY 10027

and NBER

Thomas Blake

eBay Research Labs

2065 Hamilton Ave

San Jose, CA 94125

Jett Pettus

Columbia University

Steven Tadelis

Haas School of Business

University of California, Berkeley

545 Student Services Building

Berkeley, CA 94720

and NBER

1 Introduction

Bargaining is the mechanism of choice for many of our most important transactions:

peace negotiations, federal budgets and the formation of governing coalitions, allocation

of refugees, the sale of a business, the purchase of a car, child care duties, and the

number of bedtime stories, to name a few. Yet at least since Myerson and Satterthwaite

(1983), economists have understood the potential for failure in bargaining. When

parties to a negotiation do not know each other’s reservation values, each has an

incentive to overstate the strength of their position to get a better deal, sometimes

resulting in costly delays, and other times in a complete loss of socially beneficial trades.

In this spirit, Crawford (1982) posits that “the potential welfare gains from improving

the efficiency of bargaining outcomes are enormous, perhaps even greater than those

that would result from a better understanding of the effects of macroeconomic policy.”

We consider an open question in this domain: does communication improve the

efficiency of bargaining outcomes, or is it all “cheap talk?” Charness (2012) writes:

For many, the word bargaining conjures an image of people sitting around

a table talking. Yet communication is one of the least understood facets

of bargaining. Most economic models of bargaining assign no role for

communication beyond conveying offers or their acceptability. But clearly,

communication does a lot more than that.

He continues, presciently, “this area should be of great importance in the coming

years, particularly given the strong trend to virtual interaction in bargaining.” Here,

we offer evidence on this question using data from such a virtual bargaining platform:

eBay’s Best Offer bargaining marketplace. We present two main findings: first, we

document a statistically and economically significant positive relationship between the

availability of free-form text communication and bargaining success. Second, applying

text analysis techniques to users’ messages, we document a convergent pattern which,

we argue, represents repeat players learning how to communicate in the bargaining

protocol. We show that this pattern is related to experience, and that the strategies

adopted by experienced bargainers are correlated with successful negotiation. This is

consistent with prior findings in experimental work demonstrating that beyond the

ability to communicate, the content of communication matters as well for bargaining

outcomes. Our work is, to the best of our knowledge, the first study of the role of

communication in bargaining using data from real-world bargaining interactions.

1

Our findings relate to a broader debate concerning the restriction of communication

in bargaining which, in practice, is quite common. A high stakes example from

international relations is “shuttle diplomacy,” which played a high-profile role in many

negotiation episodes in the twentieth century. Theoretical models of such mediation,

itself a medium of communication, focus on the informational role of these restrictions,

as against the theoretical limitations of baseline of unverifiable cheap talk (Fey and

Ramsay, 2010; H¨orner et al., 2015). Yet these theoretical limitations offer limited

perspective on real-world bargaining, which is rife with cheap talk (very little of which,

in our setting, resembles meaningful exchange of information).

This is particularly salient for marketplaces, where bargaining is increasingly

commonplace. eBay’s Best Offer bargaining platform, which allows sellers to receive

and respond to offers from potential buyers, accounts for approximately 10% of eBay’s

trade volume, which was

$

84 billion globally in 2016.

1

On the Chinese platform

TaoBao, which hosted trade volumes of

$

115 billion in 2016, bargaining is the standard

for all transactions.

2

And in, in 2014, Amazon.com introduced their own bargaining

mechanism for the Amazon Marketplaces platform called “Make an Offer.” All of

these platforms face the question of how and whether to regulate communication.

Our setting is the Best Offer bargaining platform on eBay.de, the German counter-

part of eBay.com.

3

Sellers who create a listing on the website may enable Best Offer,

a free feature that allows buyers to make offers below the listing price. An offer may

be countered, and the counter-offer countered, etc., yielding a protocol very similar

to sequential, alternating-offers bargaining (Rubinstein, 1982). Originally, eBay.de

did not allow communication, and only numerical offers were relayed between the

parties.

4

However, in a policy change that took effect May 23, 2016, offers could

be accompanied by a 250-character message when made from the eBay.de website.

Importantly, the change did not affect buyers who made offers using their mobile

devices. The sudden nature of the change and its incomplete coverage affords us a

natural experiment to study the role of communication in bargaining.

1

See Backus et al. (2020) and eBay’s 2016 10k SEC filing.

2

On TaoBao, communication is encouraged between buyers and sellers on an instant messenger

service. This has been cited as a factor in their success over the Chinese equivalent of eBay

(Oberholzer-Gee and Wulf, 2009).

3

This platform is also used in Gizatulina and Gorelkina (2017), who conduct a field experiment

selling gift cards on the platform to study surplus division.

4

We believe this has to do with the origins of eBay.de, which was originally developed by Rocket

Internet SE in 1999 and then sold to eBay.com. Thanks to Ariel Stern for pointing this out.

2

We find that, while the typical bargaining session in our sample was successful forty-

four percent of the time, bargainers who used messages were eight percentage points

more likely to transact than they would have been in the absence of communication.

This corresponds to a fourteen percent reduction in the rate of bargaining breakdown.

We do not observe bargainers’ private values, so “breakdown” is not the same as

inefficiency (e.g., if a seller values the product more than the buyer, then breakdown

is an efficient outcome). Therefore our computation is conservative in the sense that

the denominator is too large—the decrease in the rate of inefficient breakdown is

likely to be much larger. Additionally, examining week-specific effects, we find that

the effect of communication grows gradually over the four weeks after introduction.

One mechanism that may drive this pattern is that it takes time for players to learn

how to best make use of the new feature after the change.

To explore this mechanism, we implement a descriptive analysis of the content of

the communications. Most notably, we offer evidence that over the weeks following

the introduction of communication, sellers’ communication strategies evolve as they

learn to use the communication feature in bargaining. In contrast, the content of

buyers’ communications is largely random, which is consistent with our intuition, and

their behavior on eBay, that they are occasional, short-run players. We show that not

only are repeat sellers’ strategies changing over time, but that they are convergent,

supporting the hypothesis that they are learning. Consistent with this, we show that

messages most similar to the endpoint of that convergence are more likely to succeed,

with a magnitude that is remarkably close to our estimates of the treatment effect on

the treated from the introduction of messaging. We also, in an Appendix, borrow tools

from text analysis to learn about what sellers are converging to; though this analysis is

entirely descriptive, the findings are consistent with behavioral and experimental work

which shows that cost-based rationales are effective, and overly effusive communication

strategies can be counterproductive.

Turning to prior work, our paper is the first, to the best of our knowledge, to study

the role of communication on bargaining using real-world bargaining interactions.

There is, however, substantial prior theoretical and experimental work. Surveying

theoretical contributions, Crawford (1990) distinguishes between tacit and explicit

models of bargaining, where tacit models leave no role for communication. All of

noncooperative bargaining theory is tacit; it abstracts away from talk to focus on

actions: offers, counteroffers, delay, agreement, and exit. For practitioners, however,

3

haggling and negotiation are understood as communication, which may explain the

minor role of economic theory in negotiation coursework among students of law and

business. More recent work studies explicit bargaining, in which communication

is modeled as cheap talk.

5

There is significant disagreement on the efficiency of

allowing cheap talk: theoretical work predicts that, among rational actors, it is at

best irrelevant, and possibly detrimental to bargaining efficiency.

6

In the latter case

restricting communication is a form of pre-commitment, which may improve outcomes.

In contrast, experimental work has found potential for communication to improve

outcomes in bargaining among other games.

7

Indeed, bargaining experiments that

manipulate the availability of communication (Radner and Schotter, 1989; Valley et

al., 2002) offer evidence that communication may permit bargaining efficiency that

exceeds the theoretical upper bounds outlined by Myerson and Satterthwaite (1983).

However, these results have not been validated in the field, and subsequent extensions

are not uniformly positive: Ert et al. (2014) construct an experimental scenario with

misalignment of incentives, similar to bargaining over lemons, where communication

elicits skepticism and increases breakdown; Bolton et al. (2003) and McGinn et al.

(2012) highlight drawbacks of communication in bargaining games with more than

two players, and Lee and Ames (2017) and Jeong et al. (2019) show how the content

of the messages can facilitate or inhibit negotiations.

Communication is of interest for antitrust economics, where colluding parties have

to bargain over the division of surplus. Cooper and K¨uhn (2014) experimentally study

the role of communication in repeated Prisoners’ Dilemma games; Awaya and Krishna

(2015) show how cheap-talk communication can overcome the problem of secret price

cuts in collusive arrangements, and Harrington and Ye (2019) show how cheap-talk

5

This literature typically appends a cheap-talk “pre-game” to an existing bargaining model. See,

e.g., Farrell and Gibbons (1989), Cabral and S´akovics (1995), for early examples, and Menzio (2007)

for a formalization of partially directed search in models of cheap-talk wage-posting.

6

See Goltsman et al. (2009) for a treatment and review of communication and bargaining in the

cheap-talk setting described by Crawford and Sobel (1982), and, in the legal literature, Brown and

Ayres (1994) and Ayres and Nalebuff (1997).

7

In experiments mirroring Crawford and Sobel (1982), Cai and Wang (2006) find that subjects

consistently reveal “too much” information to be rationalized by equilibrium behavior. This is

consistent with lie aversion (Gneezy, 2005; Gibson et al., 2013) and guilt aversion (Charness and

Dufwenberg, 2006, 2011), as well as communication fostering other-regarding preferences (Coffman

and Niehaus, 2020). Crawford et al. (2013) argue that it is consistent with level-K thinking, even in

the absence of preferences for truthfulness, as L0 types anchor on the truth. In games with multiple

equilibria, communication helps coordination on better outcomes (Cooper et al., 1992; Blume and

Ortmann, 2007; Ellingsen and

¨

Ostling, 2010). McGinn et al. (2003) offer evidence for this mechanism

by showing that communication elicits dyadic strategies by bargainers.

4

communication among sellers in an upstream market can facilitate collusion when

the downstream market is characterized by negotiations, as in many intermediate

goods markets. Clark and Houde (2014) offer an empirical example of the role of

communication in collusion, studying the collapse of a cartel resulting from antitrust

enforcement equipped with a wire tap in Quebec. Moreover, in a setting that features

on-path bargaining breakdown but not communication, Loertscher and Marx (2020)

show how mechanism design can be used to understand bargaining and countervailing

power in antitrust.

Finally, our work contributes to the literature on learning in strategic settings.

Empirical work in this area is particularly scarce because there are few opportunities to

observe the introduction of a novel mechanism in a continuously operating marketplace.

In this respect, our work is related to Doraszelski et al. (2017), who document bidding

behavior in a newly opened electricity auction market. Our exercise builds on the

recent introduction of text analysis and natural language processing; see Gentzkow

et al. (2019a) for a survey. For the same reason that we need new tools to study

text—that messages live in a high-dimensional space—we conjecture that it is a natural

environment to study learning and experience.

8

Section 2 describes the eBay.de platform, and Section 3 describes the dataset and

explain the motivation for the sample design. Section 4 offers a discussion of identifi-

cation and our main causal estimates of the effect of communication on bargaining

breakdown. Section 5 presents a descriptive analysis of the text communication itself

in order to match the patterns we find, and Section 6 shows that our text analysis

findings are consistent with message-level regressions predicting successful bargaining.

Finally, Section 7 concludes with a brief discussion of the implications for platforms

and future directions for empirical work on communication and bargaining.

8

Though no prior work isolates the interaction of communication and experience in bargaining,

there is evidence of the importance of experience in bargaining: see, e.g. Card and Dahl (2012), who

documented the role of expertise in bargaining agents in arbitration, and Backus et al. (2020), who

found effects of experience on bargaining outcomes on eBay.com.

5

Figure 1: Example of a Best Offer Listing

Notes: This is an example View Item page for a Best-Offer enabled listing. A buyer may purchase at the asking price

of $55 by clicking the Buy-It-Now button, or they may engage in bargaining by clicking the Make Offer button.

2 Our Empirical Setting: Bargaining on eBay.de

2.1 Best Offer Bargaining

eBay’s online platform matches buyers to sellers who sell products ranging from art

and collectibles to mobile phones, with over

$

95 billion dollars in gross merchandise

volume worldwide in 2018. The platform operates in many markets throughout the

world, the largest by revenue are the US (eBay.com) and Germany (eBay.de).

9

Sellers who list an item choose either an auction or fixed-price (“Buy-it-Now”)

format. We focus on a subset of fixed-price listings for which the seller enables the

“Best Offer” bargaining feature as shown in Figure 1. A buyer considering this listing

has two options to purchase the good: they can either purchase at the posted asking

price (here,

$

55), or they can offer to purchase at a lower price. If the buyer makes an

offer, the seller is notified and they may then accept, decline, or make a counter-offer. If

the seller makes a counter-offer, the buyer may accept, decline, or make a counter-offer,

and so on, in the spirit of Rubenstein-St¨ahl alternating, sequential-offers bargaining.

Offers by either party expire automatically after 48 hours.

10

9

Figure and revenue ranking based on eBay’s 2018 Annual Report.

10

For a more thorough descriptive characterization of the Best Offer environment, see Backus et al.

(2020). Data from that study, which are collected from the US site eBay.com, are publicly available

at http://www.nber.org/data/bargaining/.

6

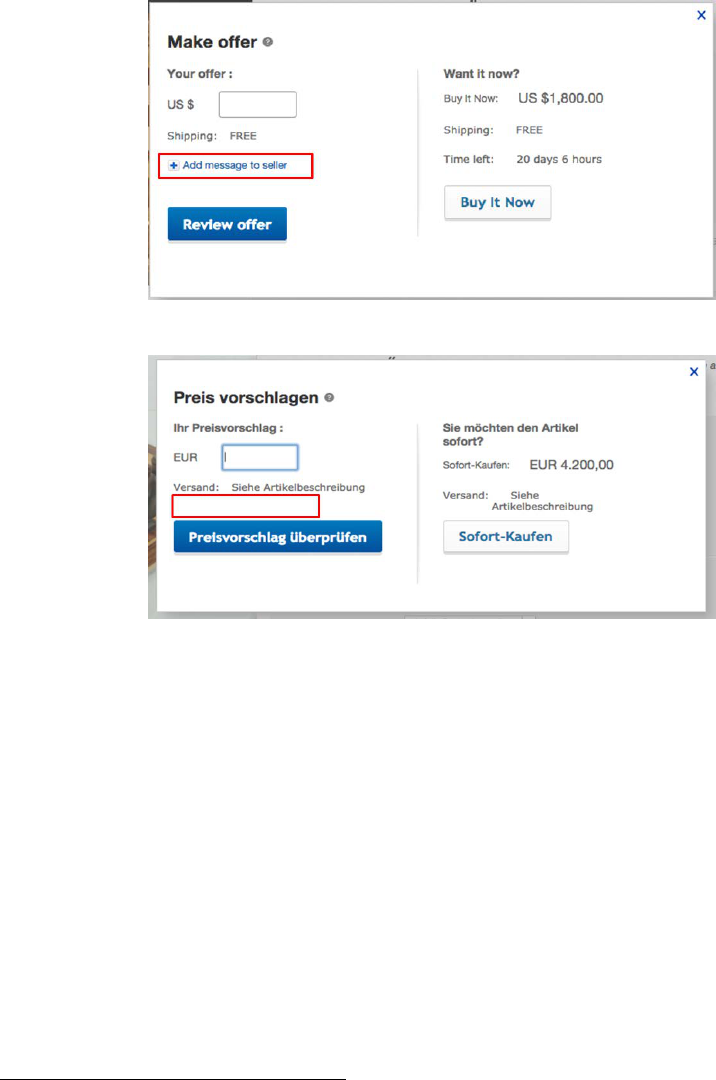

Figure 2: Messages and Best Offer

(a) eBay.com

(b) eBay.de (before May 23, 2016)

Notes: Panel (a) depicts the “Make Offer” panel for eBay.com, the US site, where we have highlighted the “add

message to seller” button. Panel (b) depicts the pre-treatment panel on eBay.de, where there is no option to send a

message.

The Best Offer bargaining mechanisms on eBay.com and eBay.de are mostly

identical except for one peculiarity that was unique to eBay.de up until the policy

change we study: bargainers weren’t allowed to communicate like on eBay.com. Figure

2(a) depicts the “Make Offer” interface through which buyers submit their offer, for

eBay.com. If a buyer clicks the “add message to seller” button, they may include

a free-form text message of up to 250 characters which will accompany their offer.

Figure 2(b) depicts the parallel “Preis Vorschlagen” interface, for eBay.de. The red

rectangle highlights where the missing option to send a message might have been.

11

11

The reason for the difference is unclear, but it may be a historical artifact: eBay.de is the

successor of Alando.de, a clone of eBay.com created by the company Rocket Internet in 1999. 100

days after its creation, it was sold to eBay for

$

43 million. Thanks to Ariel Stern of HBS for pointing

this out.

7

2.2 The Policy Change: May 23, 2016

On May 23, 2016, the “add a message to seller” feature was added to eBay.de’s Best

Offer bargaining platform. However, the rollout on that date was partial. The website

eBay.de was updated, but the app for mobile users was not.

The policy change affords the main source of variation that we will exploit in this

paper. Unlike many changes to the eBay platform, the introduction of messaging

on eBay.de was not accompanied by a far-reaching “seller update”, and no other

major changes to the eBay.de experience happened around this change. Moreover,

the availability of an untreated group in the post period (mobile users) affords us a

control group in order to separate changes in behavior from a secular trend.

3 Dataset and Sample Design

We obtained proprietary data from eBay itself to evaluate the effect of messaging

on bargaining breakdown. We study bargaining interactions, which we define as a

buyer-item pair in which we observe at least one offer. Our main dataset includes all

interactions for which the first buyer offer was made during an eight-week window

between April 26, 2016 and June 20, 2016, constructed to be four weeks before and

four weeks after the introduction of messaging on May 23, 2016.

3.1 Summary Statistics

Table 1 presents summary statistics for the main sample across several dimensions:

listings, buyers, sellers, and interactions. This sample includes 3.3 million interactions

involving 2.2 million unique listings, 444 thousand sellers, and 1.6 million buyers. The

listings span all categories of eBay excluding real estate, automobiles, and tickets. As

documented by Backus et al. (2020), Best Offer is more frequently used in categories

with substantial heterogeneity, such as Collectibles. Listings observed in our sample

have on average 1.5 interactions (note that our sample excludes listings with zero

interactions) and the distribution is highly skew: 79 percent have only one; 91 percent

8

have two or fewer, 96 percent have three or fewer, and there is a right tail with many

more.

12

55 percent ultimately sell through the Best Offer mechanism.

13

Both buyers and sellers may be involved in multiple interactions—on average, 2.1

and 7.4, respectively. In both cases there is substantial positive skew, suggesting a

large right-tail of highly-active participants. On the buyer side, this derives from the

fact that most (60%) are only observed in a single interaction, while the top decile

participates in four or more interactions. On the seller side, only 34% of the sample is

observed only once, while the top decile participates in twelve or more interactions.

This difference motivates our interpretation of buyers as short-run players and sellers

as long-run players. These patterns hold for sales and purchases as well.

At the interaction level, which is the unit of observation for the empirical analysis

that follows, we see that 44% of interactions end in a sale. These facts are consistent

with findings in prior work using data from the U.S. site eBay.com (Backus et al.,

2019, 2020). The final two interaction-level variables of Table 1 are of unique interest

to this paper: interactions may be initiated by buyers using the desktop version of

eBay (54%) or the mobile version (46%), which is important because only desktop

buyers have the opportunity to send messages after the policy change. Finally, 50% of

our sample falls after the policy change on May 23, 2016.

3.2 Additional Controls

In addition to the basic characteristics summarized in Table 1, we have a number of

controls available to predict bargaining breakdown. These include the asking price of

the seller; dummy variables by product category and condition (new, used, refurbished,

or unknown); and dummy variables for the day of the week on which the first offer in

an interaction is made (to allow for differential behavior on weekends and weekdays);

a “holiday” dummy, which encodes all publicly observed holidays in Germany, as

there is a particularly large number of them in May.

14

We also include controls for the

weather in Frankfurt, Hesse, which we expect to be correlated with weather elsewhere

12

Partly for this reason, and partly because Best Offer listings tend to take longer to sell than, say,

auctions, we ignore the possibility of competing offers by buyers. This is intuitive, since sellers also

have the option to hold an auction on the eBay platform.

13

Listings that sold at the Buy-it-Now price are not classified as an interaction because no

negotiation is involved. These sales do not appear in our dataset.

14

Publicly observed holidays in our sample include: May 1, Labor day; May 5, Ascension Day;

May 8, Mother’s Day; May 16, Whit Monday, and May 26, Corpus Christi.

9

Table 1: Summary Statistics

Mean Std. Dev. Skewness Min Max

Listing-Level Data

Asking Price (USD) 100.6 151.5 2.889 1.050 999.9

Number of Interactions 1.490 2.566 82.62 1 1004

1(Sold) 0.563

N 2210575

Seller-Level Data

Number of Interactions 7.426 42.30 47.81 1 7142

Number of Sales 3.279 20.76 44.17 0 3115

N 443644

Buyer-Level Data

Number of Interactions 2.101 3.102 20.24 1 396

Number of Purchases 0.928 1.526 25.26 0 389

N 1567995

Interaction-Level Data

Number of Offers 1.873 1.116 1.535 1 6

1(Ended in Sale) 0.442

1(Buyer on Desktop) 0.537

1(First offer after May 23) 0.501

N 3294362

Notes: This table presents summary statistics for the main dataset of Best Offer interactions taking place within an

eight-week window, four weeks before and four weeks after the policy change on May 23, 2016. Fixing that set of

interactions, we have constructed the summary statistics four ways: where the unit of observation is the listing (i.e.,

the product), the buyer, the seller, or the interaction itself.

in Germany, as weather conditions are both serially correlated and anecdotally cited

as affecting online activity. These include a dummy for precipitation as well as the

deviation of temperature from a linear trend over the sample.

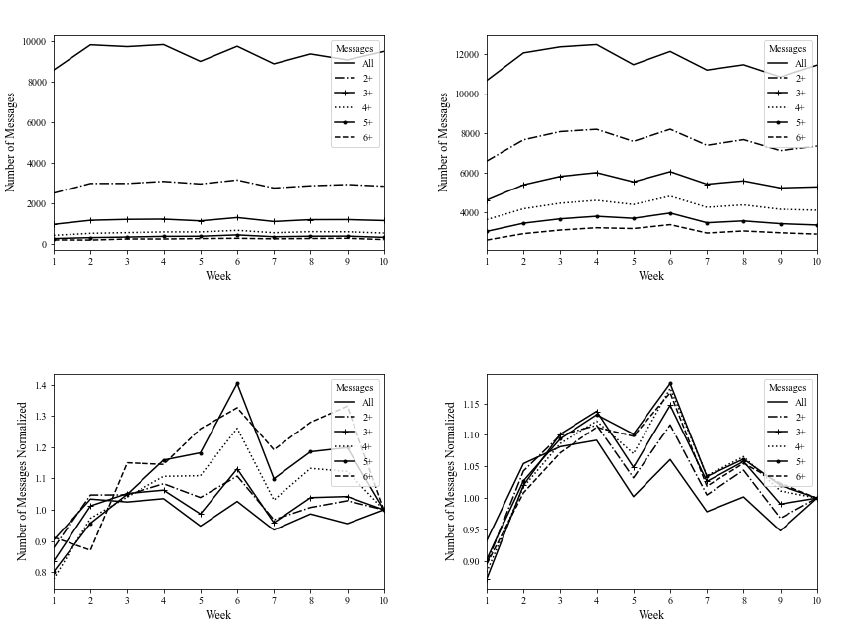

3.3 Adoption on May 23, 2016

As depicted in Figure 3(a), users adopted messages rapidly: within days, the hazard

rate with which bargaining interactions by desktop-only buyers involved messaging

stabilized at approximately six percent. Both panels in Figure 3 distinguish between

the case where the buyer is either exclusively making offers from a desktop computer

or exclusively making offers from a mobile device. We do this because there was

initially no messaging feature for the eBay.de mobile app. Therefore in Panel (a),

which plots the hazard rate at which interactions involve any message (both seller and

buyer messages), the hazard rate for the case where the buyer is on the mobile app is

much lower. These are exclusively messages sent by sellers, to mobile-only buyers who

10

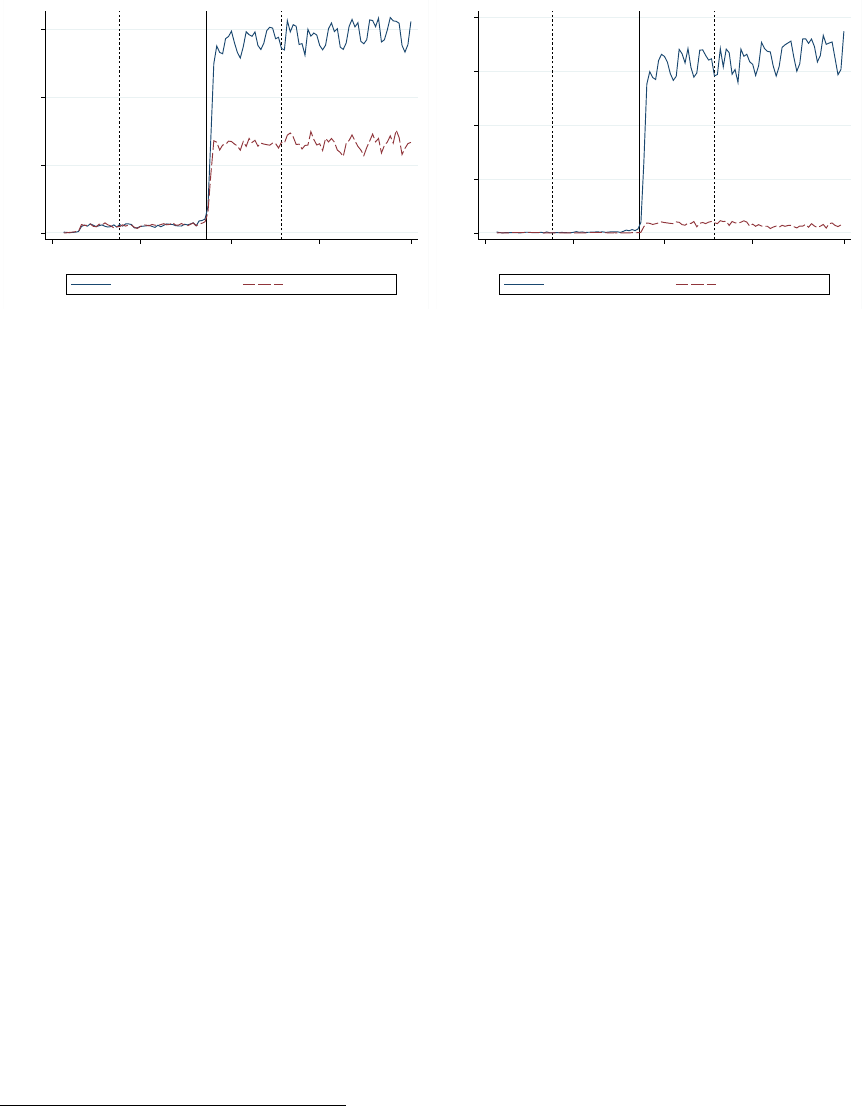

Figure 3: Launch of Messaging Feature

0 .02 .04 .06

Fraction with Any Message

01apr2016 01may2016 01jun2016 01jul2016 01aug2016

Time

Buyer is Desktop Only Buyer is Mobile Only

(a) Any Message

0 .01 .02 .03 .04

Fraction with Buyer Message

01apr2016 01may2016 01jun2016 01jul2016 01aug2016

Time

Buyer is Desktop Only Buyer is Mobile Only

(b) Buyer Message

Notes: Panel (a) depicts the fraction of interactions, by first offer date, in which a message was included by the seller.

Panel (b) restricts attention to cases where the message was sent by a buyer. Both panels split the sample by whether

the buyer was active on the desktop or mobile version of the platform. The solid vertical line represents the policy

change. Dashed vertical lines depict the bounds of the eight-week window, centered at launch, of our main sample.

cannot read them. In Panel (b), we plot the hazard rate of buyer messages, which

confirms that mobile-only buyers are not sending messages after the change.

15

4 The Effect of Introducing Communication on

the Likelihood of Bargaining Breakdown

4.1 Empirical Design and Identification

4.1.1 OLS and Endogeneity

Our identification strategy is meant to circumvent the most salient problem, that the

choice to include a message is endogenous. In particular, we expect a negative bias:

that bargainers send messages for goods of a type where bargaining is least likely to

succeed, or in order to motivate a particularly aggressive offer.

We illustrate this by estimating a linear probability model, the details of which

can be found in Appendix Section A. The unconditional correlation between the

15

About 0.1% of offers per day included messages prior to the feature launch, and similarly there

are cases where mobile-only buyers appear to send messages. In the former case, these are seller-side

only, and rarely in German, so we believe that they are anomalies related to sellers registered on

multiple sites. In the latter, we believe that these are simple database errors.

11

presence of a message and bargaining success is negative, but once we condition

on the log of the asking price it is small and positive. This reflects the fact that

bargaining interactions with messages tend to involve goods that are more expensive

than bargaining interactions that do not, and that bargaining success is less likely for

more expensive products, as documented by Backus et al. (2020) for eBay.com.

We expect this problem to be at least as important for unobservable characteristics

than the asking price, and therefore rely on the policy change for a natural experiment

and a more credible estimate of the effect of communication on bargaining breakdown.

4.1.2 Identification

The variation generated by the May 23, 2016 policy change allows us to identify the

effect of communication in two ways. The first is a simple pre-post design studying

the change in the mean success rate of bargaining interactions before and after the

policy change among desktop users. Our dependent variable is

1

(success), a dummy

for whether the bargaining interaction ends in a sale. Let

X

denote a set of controls,

P

(alternatively, “post”) a dummy equal to one if the first offer in an interaction is in

the post period, and

D

(alternatively, “desktop”) a dummy equal to one if the buyer

makes offers from the desktop version of eBay.de. Then, the pre-post estimate of the

effect of communication on bargaining success is given by:

ˆ

β

C

pp

= E[1(success)|X, P = 1, D = 1] − E[1(success)|X, P = 0, D = 1]. (1)

We can then use the untreated set of buyers who made offers on the mobile

platform—where messaging was unavailable both before and after May 23, 2016—to

control for common trends and alleviate concerns of endogeneity. This suggests a

differences-in-differences design:

ˆ

β

C

dd

=(E[1(success)|X, P = 1, D = 1] − E[1(success)|X, P = 0, D = 1]) (2)

− (E[1(success)|X, P = 1, D = 0] − E[1(success)|X, P = 0, D = 0]).

Both of the above strategies identify an effect that should be interpreted as an

intent to treat (ITT) estimate, i.e., an estimate of the effect of the availability of

communication, rather than the effect of actually choosing to communicate. In order

12

Table 2: Complier Characteristics

P(x=1) P(x = 1 | complier)

P(x=1|complier)

P(x=1)

Ask Price in ($0,$50) 0.52 0.41 0.78

Ask Price in [$50,$150) 0.27 0.29 1.08

Ask Price in [$150,$250) 0.09 0.11 1.30

Ask Price ≥ $250 0.12 0.19 1.54

Friday, Saturday, or Sunday 0.42 0.42 1.00

Precipitation 0.46 0.67 1.46

Holiday 0.10 0.03 0.32

Post 0.50 1.00 2.00

Desktop 0.54 1.00 1.86

Notes: This table summarizes complier characteristics, i.e. the characteristics of interactions in the treatment group

that “comply” and involve a message between bargainers. Each row represents a dummy variable which is taken to

be x in the column formulas above.

to identify the treatment effect on the treated (TOT), we need to clarify who the

compliers, i.e., those we actually consider to be treated, are.

4.1.3 ITT and TOT: Who are Compliers?

We say that a bargaining interaction is in the ITT group if the first offer occurs after

May 23, 2016 and if the buyer uses the desktop version of eBay.de. Not every such

interaction involves a message. By definition, compliers are interactions in our ITT

group in which a message is sent by either party. Some messages were sent outside of

this group, e.g., when a seller sends a message to a buyer who is using the mobile app.

We exclude these for two reasons: first, because the buyer was mechanically unable

to read the message, and second, because it turns out that using this less-restrictive

definition will cause us to overstate the magnitude of the TOT estimate.

16

Table 2 summarizes the characteristics of the compliers. Of particular note is the

fact that bargainers are more likely to send messages when the asking price is higher,

consistent with the intuition that communication is costly. The higher likelihood of

precipitation and lower likelihood of a holiday is due mostly to early-May holidays and

late-May rains, and we note that weekend users are no more likely to send messages.

17

16

Results are available on demand from the authors, however the intuition is simple: including

messages in the pre-period or mobile set but not in the intent-to-treat group will inflate the coefficients

on

1

(Post) and

1

(Desktop), respectively, and thereby depress the coefficient on

1

(Post)

·1

(Desktop).

Since the first-stage coefficient (which is in the denominator) is smaller, the IV effect will be inflated.

Including all non-ITT messages will approximately double the estimate.

17

We group Friday, Saturday, and Sunday based on the OLS coefficients reported in Table A-1,

where weekends appear to be discretely different from weekdays.

13

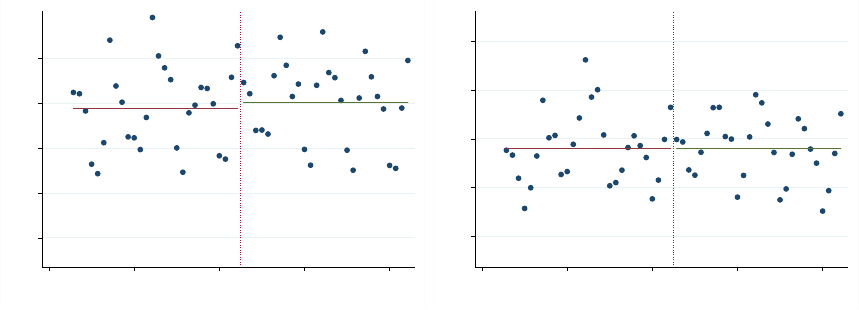

Figure 4: Predicted Success Rates

.44 .45 .46 .47 .48

Predicted Probability

22apr2016 06may2016 20may2016 03jun2016 17jun2016

Day

(a) Desktop

.39 .4 .41 .42 .43

Predicted Probability

22apr2016 06may2016 20may2016 03jun2016 17jun2016

Day

(b) Mobile

Notes: Panel (a) depicts predicted success rates using a large set of controls (ln(ask price); category by condition

fixed effects; day of week, precipitation, and holiday dummies and the temperature) for desktop users only. Panel (b)

replicates this for the mobile users. The vertical axes on both plots are scaled identically subject to a location shift.

It is natural to wonder whether despite our controls, unobservable characteristics

of the listings are generating compositional differences in the periods before and after

the change. Therefore, in Figure 4 we document the predicted success rate conditional

on those controls for all interactions for both samples—mobile and desktop—where

the first-stage regression excludes the dummy for treatment as well as the time trend.

We see a small change in the predicted likelihood of success for desktop users and none

for mobile users, so we anticipate slightly smaller effects when we include controls.

4.2 Empirical Results

4.2.1 Regression Analysis

In what follows, we first generate precise estimates

ˆ

β

C

pp

and

ˆ

β

C

dd

, and second, we identify

a treatment effect on the treated because, recall from Figure 3, only a small fraction

of interactions in the post period involve a message. To accomplish the former, we

reformulate (1) and (2) in terms of a linear probability model and estimate them using

OLS (in all of what follows we omit observation indices):

1(success) = β

0

pp

+ Xβ

1

pp

+ P β

C

pp

+ ε, (3)

and

1(success) = β

0

dd

+ Xβ

1

dd

+ P β

2

dd

+ Dβ

3

dd

+ P Dβ

C

dd

+ ε. (4)

14

Next we consider the treatment effect on the treated. We estimate this by reformulating

(4) as an instrumental variables regression:

1(success) = β

0

iv

+ Xβ

1

iv

+ P β

2

iv

+ Dβ

3

iv

+ 1(complier)β

C

iv

+ ε, (5)

where

P · D

is an instrument for

1

(complier), and

1

(complier) is a dummy for

interactions in the ITT group that include a message. Importantly, this does not

employ any variation that is not already used in the differences-in-differences estimator.

Instead, it just rescales the estimate to the end of interpreting its economic meaning.

As with all estimates of the treatment effect on the treated, it should be interpreted

with caution, as bargainers’ decision of whether to send a message is endogenous.

Results for each of these three estimators, both with and without the controls

discussed in Section 2, are presented in Table 3. We see a large effect of the policy

change on success for desktop users, 0.46 percentage points in model (1), which is

attenuated by the inclusion of controls to a statistically insignificant effect of 0.23

percentage points in model (2). As we show in the next section, the control that

attenuates the result is the time trend. In the post period, there is a substantial

positive drift, which stabilizes after a few weeks. Is this a delayed treatment effect, or

a secular trend on the platform? To distinguish between these hypotheses, we need a

suitable control group; here, interactions involving buyers who use the mobile app.

Critically, as we see in models (3) and (4), our estimates of

β

C

pp

for the placebo

sample of mobile users are very close to zero. Therefore, differences in differences

estimates in models (5) and (6), where the relevant estimate is the term on the

interaction effect, are of the same order as those in (1): we estimate effects of 0.40

and 0.42, respectively. In particular for specification (6), with the rich set of controls,

the mobile group is distinguishing common time trend from the ITT estimate.

Finally, models (7) and (8) report the IV estimates which are rescaled to obtain the

TOT estimate. As only a small fraction of users, approximately six percent, actually

send messages in the post period, this means that the roughly half-percent effect on

conversion for the Best Offer environment at large translates to a substantially larger

and economically important effect on the treated. To be precise, versus a baseline

probability of success near 44% for the full sample (from Table 1), interactions that

involve messages in the treated group are 7.44 (or 7.73, with controls) percentage

points more likely to succeed. The inclusion of these controls (time trend; ln(ask price);

category by condition fixed effects; day of week, precipitation, and holiday dummies

15

and the temperature) allows us to rule out the most salient alternative hypotheses

by which the effect is driven by compositional changes spurred by the introduction

of communication, e.g. if messaging prompts buyers to bargain over cheaper goods

which also have lower rates of breakdown. This leaves is with our main result: a 14%

decrease in the rate of bargaining breakdown among the compliers.

Finally, a note on size and power: we are looking at extremely small effects, on

the order of half a percentage point. They are small because take-up of the messaging

feature among the ITT group, i.e., the compliance rate, is low, at approximately six

percent. While we have a lot of data in our main sample—3.41 million bargaining

interactions—this turns out to be close to what we need. Simple power calculations for

the detection of an effect of 0

.

005 with a baseline success rate of 0

.

442 (borrowed from

Table 1) with a confidence of

α

= 0

.

05 and a power of fifty percent implies that we

need a dataset of 2.72 million experimentally generated observations equally divided

between treated and not. Therefore there are limitations on how far we can push the

data to understand heterogeneity in the effects of communication.

While the low compliance rate is, in that sense, an empirical challenge, there is

also a sense in which it is an advantage of our environment. If the greater fraction

of buyers sent messages—and those messages were important for bargaining—then

their communication might have an equilibrium effect on the quantity, composition,

or listing style of goods on the platform. In the language of Angrist et al. (1996),

these are concerns about the stable unit treatment value assumption (SUTVA)—i.e.,

that treatment of some observations has spillover effects on the effectiveness of the

treatment for others. The fact that the compliance rate is very low reassures us that

they are not economically significant, and that we can identify a partial equilibrium

effect, i.e. conditional on the broader state of eBay.de in the Summer of 2016.

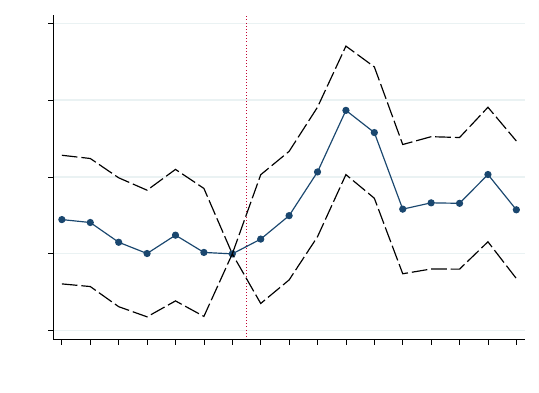

4.2.2 Graphical Intuition

In order to offer some intuition for the results in Table 3, Figure 5 presents the data

aggregated to the daily level, both with and without residualization on a large set of

controls.

18

In both cases we see an apparent jump in the success rate of approximately

18

Note that while we will include it in the regression analysis that follows, we have excluded a

time trend from the set of controls here. Coefficients from the OLS regression that generates these

residuals are reported in model (6) of Table A-1 in the appendix, where we present OLS results as a

straw man alternative to our empirical design.

16

Table 3: Effect of Messaging on Success Rate

Desktop Mobile Differences IV

(1) (2) (3) (4) (5) (6) (7) (8)

1(Post) 0.0046

∗

0.0023 0.0006 0.0031 0.0006 0.0005 0.0006 0.0009

(0.0013) (0.0019) (0.0013) (0.0019) (0.0013) (0.0015) (0.0013) (0.0015)

1(Desktop) 0.0599

∗

0.0482

∗

0.0599

∗

0.0482

∗

(0.0013) (0.0011) (0.0013) (0.0011)

1(Post) · 1(Desktop) 0.0040

∗

0.0042

∗

(0.0013) (0.0012)

1(Complier) 0.0744

∗

0.0773

∗

(0.0240) (0.0226)

Controls X X X X

N 1770261 1770261 1524101 1524101 3294362 3294362 3294362 3294362

Notes: This table depicts our main regression results. Even-numbered specifications include controls (time trend; ln(ask price); category by condition fixed effects; day

of week, precipitation, and holiday dummies and the temperature), while odd ones include none. Specifications (1) and (2) report a linear regression on a dummy for

being in the treatment period on a sample of desktop users (who are treated), while specifications (3) and (4) conduct the same exercise on a placebo sample of untreated

mobile users. Specifications (5) and (6) combine the samples in a differences-in-differences approach, and finally specifications (7) and (8) take an instrumental variables

approach, using the same variation, to identify a treatment effect on the treated for the combined sample. Heteroskedacticity-robust standard errors, clustered by seller,

are reported in parentheses, and

∗

denotes statistical significance at α = 0.05.

17

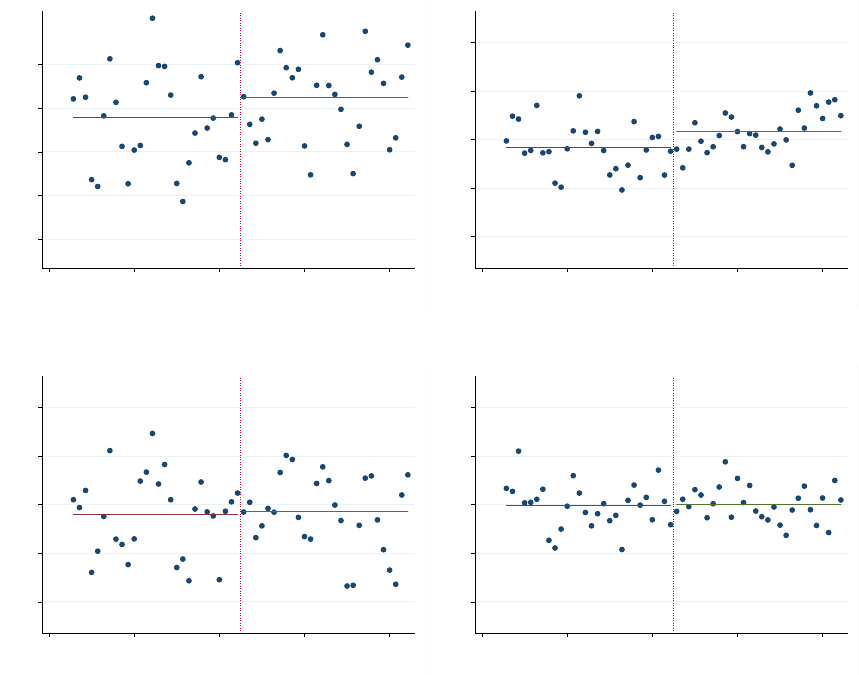

Figure 5: Bargaining Success Rates

.44 .45 .46 .47 .48

Success Rate

22apr2016 06may2016 20may2016 03jun2016 17jun2016

Day

(a) Desktop: Raw

−.02 −.01 0 .01 .02

Residual

22apr2016 06may2016 20may2016 03jun2016 17jun2016

Day

(b) Desktop: Residuals

.39 .4 .41 .42 .43

Success Rate

22apr2016 06may2016 20may2016 03jun2016 17jun2016

Day

(c) Mobile: Raw

−.02 −.01 0 .01 .02

Residual

22apr2016 06may2016 20may2016 03jun2016 17jun2016

Day

(d) Mobile: Residuals

Notes: Panels (a) and (c) depict scatterplots of the raw daily success rates for bargaining interactions grouped by

the date of the first offer for desktop and mobile, respectively. Panels (b) and (d) depict residuals from a linear

probability model regressing a dummy for successful bargaining on a large series of covariates (ln(ask price); category

by condition fixed effects; day of week, precipitation, and holiday dummies and the temperature) for desktop and

mobile, respectively. The vertical axes on both plots are scaled identically subject to a location shift.

half a percent. Two other features are apparent—first, there is substantial variation

between days in the success rate of bargaining interactions, although this is rather

smaller when we condition on the set of controls. Second, and more importantly, it

appears that there is a positive drift in the residuals during the post period. In Section

5 we will offer a simple economic explanation for this finding: buyers and sellers are

learning to communicate in the weeks following the policy change, leading to new

behavior and better outcomes.

Consistent with models (3) and (4) of Table 3, we see no evidence of change in

the likelihood that interactions are successful for buyers using the mobile platform..

18

We also see no positive drift in the residuals in the post period. This rationalizes our

finding for the difference in differences estimator

ˆ

β

C

dd

in models (5),(6),(7), and (8).

4.2.3 Week-Specific Treatment Effects: Parallel Trends and Dynamics

Next, we estimate a variant of (4) with week-specific effects over our eight-week sample:

1(success) = β

0

dd

+ Xβ

1

dd

+ P β

2

dd

+ Dβ

3

dd

+

X

t

P D · 1(week t)β

C,t

dd

+ ε. (6)

We are interested in this model for two reasons. First, the divergence in the residualized

scatterplots for desktop, Figure 5(b), and mobile, Figure 5(d), in the post-treatment

period suggest that the effect of communication on bargaining is not immediate but

delayed. Estimating week-specific effects will allow us to characterize these dynamics.

Second, following Autor (2003), estimating week-specific effects in the pre-period

allows a partial test of the parallel trends assumption. If estimated week-specific

effects in the pre-period are significant, this would violate Granger causality—that is,

the effect would precede the cause, marking a failure of our identifying assumptions.

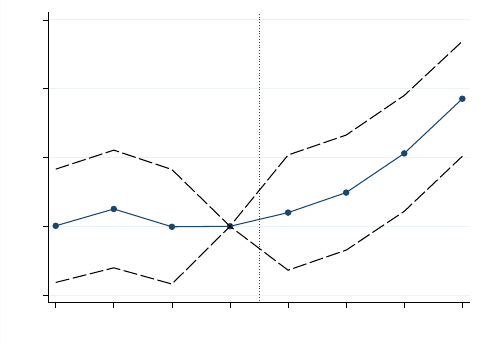

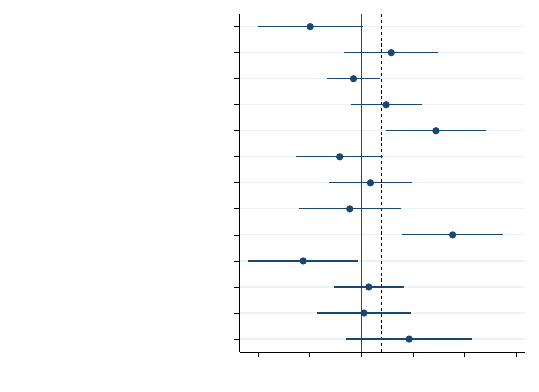

Results are depicted in Figure 6. We normalize the effect for week zero (just before

the policy change) to zero. In the pre-period, our test of the joint significance of the

coefficients fails to reject with a F-statistic of 0.11 (and an associated critical

p

value

of 0.9550). Therefore, we find neither a violation of the parallel trends assumption nor

of Granger causality for our sample. Furthermore, the model permits us to interpret

the positive drift in the post period from Figure 5(b) as a time-variant effect of

communication. Despite almost instantaneous adoption, it took several weeks for the

effects to be fully seen in the probability of bargaining success—this is perhaps not

surprising, as conventions for communication may have taken some time to stabilize.

19

We investigate this further with the content of the messages in Section 5.

4.3 Additional Specifications and Outcomes

Next, we summarize results from additional specifications, all of which are discussed

in more detail in the Appendix.

We are interested in the effect of communication on other bargaining outcomes

besides breakdown, especially in the hope that this might help us understand mecha-

19

In Appendix 1 we estimate week-specific effects for the longer sample and show that the effect of

communication on bargaining success stabilized and was consistent after week five.

19

Figure 6: Week-Specific Effects

−.005 0 .005 .01 .015

Estimated Effect on Success Rate

−3 −2 −1 0 1 2 3 4

Week

Notes: This figure depicts week-specific effects using the diff-in-diff approach with the main sample, 4 weeks before

and 4 weeks after the policy change. The omitted coefficient (normalized to zero) is the week just prior to the change.

Dashed lines represent a 95% confidence interval with heteroskedacticity-robust standard errors clustered by seller.

nisms and distributional consequences. With the caveat of limited power, we document

our efforts in Appendix B. We find no statistically significant effects on the number of

rounds or the first offer, but we do see a strong negative effect on the agreed-upon

price. Examining this more closely, we condition on who made the final (accepted)

offer in that sample, and find suggestive evidence that bargainers are successfully

using messages to not only close the deal, but also to obtain more of the surplus.

In addition, in Appendix C we investigate heterogeneous treatment effects across

asking price ranges and categories. Here our limited power is binding, however we find

suggestive evidence that the effects are somewhat larger at lower price ranges (however,

this is substantially flattened when we consider proportional effects, as success rates

are much lower for higher asking price products).

Also, in Appendix D we consider robustness checks along two dimensions: first,

the window used to construct the estimation sample and second, the inclusion of seller

fixed effects. Both are supportive of the results of Table 3. We note that shortening

the sample makes the effects no longer statistically significant, as one might intuit

from Figure 6; that in extending it, the upward trend in Figure 6 stabilizes, and that

seller fixed effects somewhat attenuate the result (from 0.0773 to 0.0561).

20

5 Evidence of Learning from Text Analysis

In Section 4, we found a positive and significant relationship between bargaining

efficiency and messaging. Moreover, by analyzing the week-specific effects of messaging,

we observed that it took time for the full effect of communication to materialize. In

this section, we explore the messages themselves in order to offer a plausible economic

story for the strengthening relationship between messaging and bargaining success.

We compute the change in messaging content across weeks for both buyers and

sellers, and are able to uncover some compelling patterns in messaging content.

Namely, we find that messages sent by repeat sellers, or sellers who are sending

multiple messages in our sample, are becoming more similar in content as the weeks

pass. We additionally find convergent patterns in seller messages: specifically, the rate

at which seller messages are changing is decreasing. These trends in seller messages are

consistent with experience-based learning in which sellers adopt messaging strategies

over time. We do not find similar results for buyers, where there are far fewer who are

sending multiple messages in our sample.

5.1 Messaging Data

We have 248,722 messages of buyer and seller interactions for the ten-week period

succeeding the introduction of messaging beginning on May 25, 2016.

20

We process

these messages through the following steps: First, we identify and keep only the

messages sent in German in order to maintain a common corpus of words for our

analysis; this makes up the vast majority (81.1 percent) of our dataset with the next

most common language being English (which accounts for 6.4 percent of the messages).

Second, the lower-cased messages are stripped of non-alphabetic characters, urls, extra

spaces, and a list of common stop words—these are words such as “and” and “the”

that provide little meaning in our messages. We then apply NLTK’s German Snowball

Stemmer (Bird et al. (2009)) to the tokens (ie. words) in each message so that they are

transformed to their original stems. For instance, the word “angeboten” (“offered”) is

minimized to “angebot” (“offer”). This step is common practice in natural language

processing and allows us to consider effectively synonymous words as the same word.

21

20

Our textual analysis starts two days after the change due to low take up on May 23-24, 2016.

21

Please refer to Appendix Section E2 for a more detailed discussion of the construction of our

messaging dataset, including a description of the list of stop words we remove from our dataset.

21

Table 4: Buyer and Seller Messaging Characteristics Based on Experience

Number of Messages Unique Individuals Average Message Length Success Frequency

Buyer

All Messages 93576 76415 9.293 0.309

One Message 64648 64648 9.250 0.339

Two - Four Messages 25595 11271 9.379 0.244

Five+ Messages 3333 496 9.475 0.240

Seller

All Messages 116081 60076 8.513 0.228

One Message 40350 40350 8.218 0.243

Two - Four Messages 40541 16375 8.561 0.213

Five+ Messages 35190 3351 8.796 0.227

Notes: In the first column messages are split based on whether the message’s corresponding buyer or seller sent one,

two to four, or five plus messages. Average message length refers to the average number of tokens in each message for

that group. Success is defined by whether that message ends in a sale.

The final reduced dataset amounts to 209,658 messages split into 93,577 buyer

messages and 116,081 seller messages. Table 4 provides descriptive statistics for buyer

and seller messages split by experience level, which we define as the total count of

messages sent by that seller or buyer over the ten-week period. Here we see that

buyers tend to be “short-run” players, with only 496 buyers sending five or more

messages. In contrast, individual sellers are more persistent in our dataset—there are

3,351 who are sending five or more messages.

Next, Table 5 depicts the ten most common tokens for buyers and sellers. Here,

sellers messages appear to be slightly more negative in messaging content as “not”

is the second most common word; additionally, “unfortunately” is the eighth most

frequent token to appear in seller messages. For a more thorough description of the

messages in our dataset, see Appendix Section E.

5.2 Empirical Challenges and Methods

Representing textual data constitutes a unique and increasingly common challenge

in empirical research. In order to analyze seller and buyer messages, we must first

construct a measure for the content of each message.

To do this, we split each message into a series of bigrams, a two-word pairing

formed from consecutive words. For example, message

m

as “this is my last offer”

would be broken up into the parts: [“this is,” “is my,” “my last,” and “last offer”].

Splitting the messages into bigrams, rather than single-word tokens, allows us to

22

Table 5: Buyer and Seller Most Common Tokens

Rank Buyer Token Translation Frequency Seller Token Translation Frequency

1 Hallo Hello 0.031 Nicht Not 0.032

2 Wurd Would 0.030 Hallo Hello 0.024

3 Gruss Greeting 0.025 Gruss Greeting 0.023

4 Versand Shipping 0.018 Preis Price 0.021

5 Nicht Not 0.016 Euro Euro 0.020

6 Euro Euro 0.015 Versand Shipping 0.016

7 Mfg Kind regards 0.011 Leid Unfortunately 0.015

8 Dank Thanks 0.011 Dank Thanks 0.013

9 Kauf Purchase 0.010 Schon Beautiful 0.012

10 Preis Price 0.010 Mfg Kind regards 0.011

Notes: This table reports the frequency of the ten most common tokens in our processed dataset for buyers and sellers.

Tokens are translated to English for readability.

simplify each message while still incorporating some level of context in our textual

analysis. An example of this are the words “screw” and “you,” put together “screw

you” has a much stronger meaning than the two words apart.

Next, we collapse our data into what is known as a “bag-of-words,” or in our

case, a “bag-of-bigrams,” where each message is a row and each bigram a column.

This exercise is frequently used in natural language processing (see Gentzkow et al.

(2019a)); however, as analyzing textual data is still relatively new to economics, we

will detail what this means below.

Our bag-of-bigrams is in the form of the matrix

C

i

, where element

c

i,mj

corresponds

to the number of counts for phrase

j

in message

m

for group

i

, ie. some group of buyers

or sellers.

C

i

is a high dimensional matrix. For instance,

C

s

for all seller messages

in our dataset makes up a 116,081-by-287,241 matrix accounting for 116,081 seller

messages and the 287,241 distinct bigrams that appear in these messages. Similarly,

C

b

for buyer messages forms a matrix with dimensions 93,577-by-331,904.

We are interested in changes in messaging content at the weekly level: Thus, we

collapse

C

i

to

C

0

i

.

C

0

i

is a ten-by-

X

matrix with each row corresponding to a week

in our ten-week sample and

X

representing the number of distinct bigrams sent by

group

i

. Element

c

0

i,wj

then equates to the number of times phrase

j

appears in the

messages sent during week w by group i.

Finally, we take vector

v

w

from row

w

of

C

0

i

and compute the cosine distance

between

v

w

and all rows in

C

0

i

. The cosine distance between vector

v

w1

and

v

w2

is

23

given by

1 −

v

w1

· v

w2

|v

w1

||v

w2

|

, (7)

where · represents the dot product and |v

w

| is the `

2

norm.

The cosine distance measures one minus the cosine of the angle between

v

w1

and

v

w2

and is a standard method for computing text dissimilarity. The normalizing term

in the denominator of

(7)

is desirable in our case as it scales the distance between

the two vectors by each vector’s length. This is essential in our context as the sum

of bigram counts varies week from week due to changes in the take-up of messaging,

holidays, etc. Finally, the cosine distance is our metric of choice as it supplies an

intuitive measure of the distance between bigram counts across weeks. Since our

vectors are by construction composed of nonnegative values, the cosine distance in

this case will always be in the range [0

,

1]

.

Here, two weeks with orthogonal vectors

will have a cosine distance of 1, whereas the cosine distance will approach 0 as the

two vectors get more similar in counts.

Finally, in order to clearly present the cosine distances across each pairing of

weeks, we construct a ten-by-ten matrix of cosine distances with the

w

1

w

2

th element

corresponding to the cosine distance between the vector of bigram counts in week

w

1

and the vector of bigram counts in week w

2

.

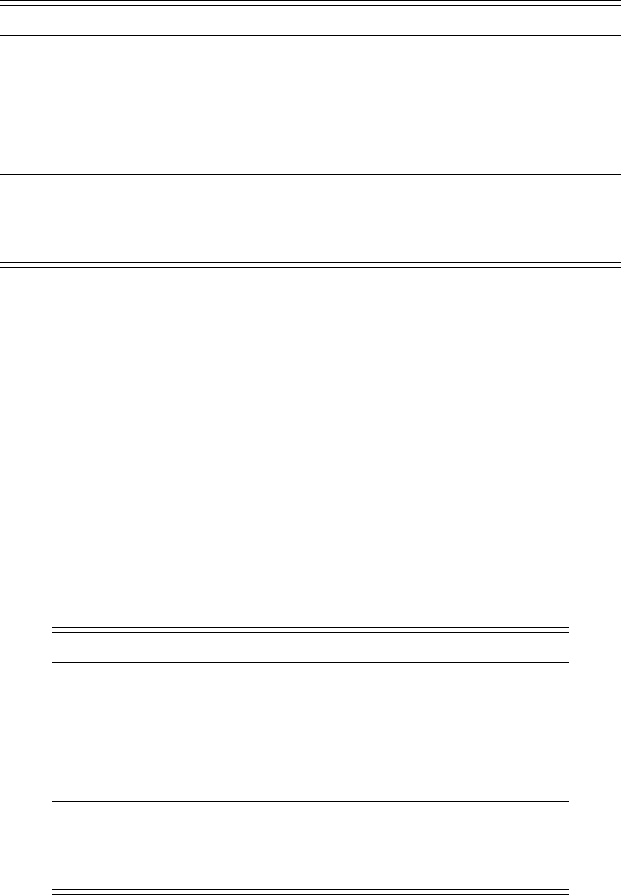

5.3 Dynamics of Communication by Experience

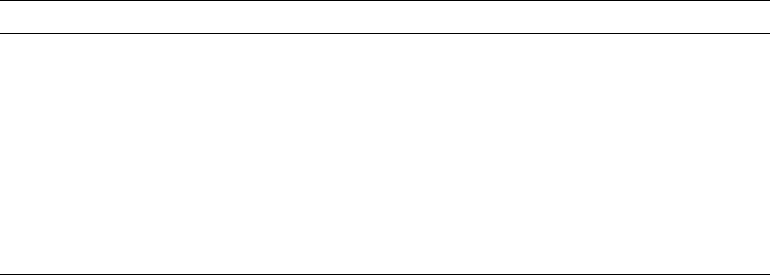

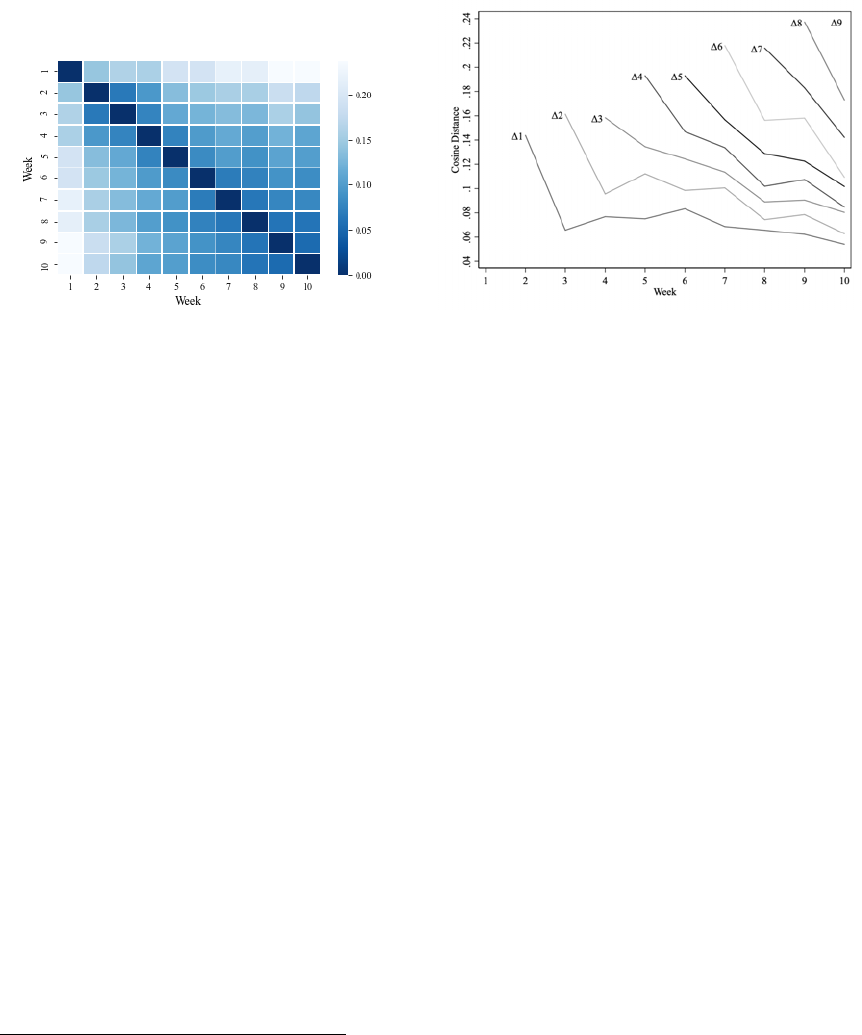

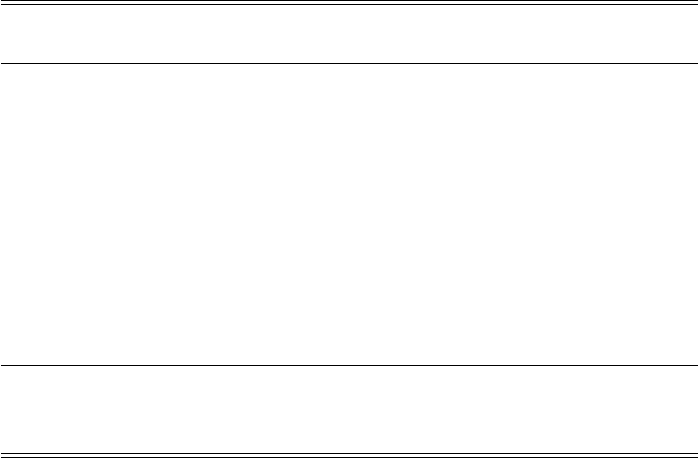

In Figure 7, we present our results through a heat map depicting the cosine distances

between the bigram counts across weeks for buyers, Panel (a), and sellers, Panel

(b). The colors indicate cosine distances in which the lighter boxes convey greater

differences in messaging content, while the messages get more similar as the boxes get

darker.

In Panel (a) of Figure 7, the cosine distances between buyer messages is stable

across our ten-week period; we can see this as all the boxes in the heat map appear to

be similar shades of blue. Table 4 offers a plausible explanation for this consistency in

buyer messages across weeks: There are few buyers in our sample sending multiple

messages. Specifically, only 3,333 messages are sent from buyers whose total message

count is five or more. In contrast, 35,190 messages are sent by sellers with five or more

messages. Due to the lack of repeat buyers, any changes in Panel (a) are presumably

24

Figure 7: Cosine Distance of Buyer and Seller Messages by Week following the

Introduction of Messaging

(a) Buyer (b) Seller

Notes: This figure presents the cosine distance of the bigram counts in the messages between each of the ten weeks

following May 25, 2016, for buyers, in Panel (a), and sellers, in Panel (b).

due to noise and week-effects. For instance, we observe differential usage of the word

“urlaub” or “vacation” in our sample. Buyer messages include “vacation” 61 times

during the week of July 20th, while they only mention “vacation” 21 times during the

first week of our sample (May 25 – 31).

Panel (b) of Figure 7 portrays starkly different results; here, there are clearly

changes in content across sellers messages from week to week as made evident due to

the patterns of color occurring in seller messages. Still, it is challenging to discern

exactly how seller messages are transforming. In order to amend this, there are two

ways in which we can more intuitively decipher the patterns presented in the heat

maps. First, we can more closely observe the bottom gradient of the heat maps, where

we are comparing the differences in messaging content between week w and week 10.

Second, we can plot the off-diagonals of the heat maps in order to see the rate of

change in message content. The former will tell us whether the content of the text is

changing systematically, where the latter will tell us whether it is convergent. That is,

if the rate of change is decreasing, we take this as evidence of the convex pattern that

is signature of models of learning and information: that our first data points teach us

more than those that follow.

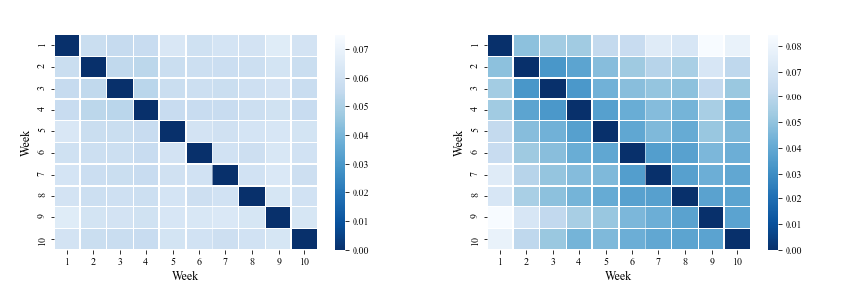

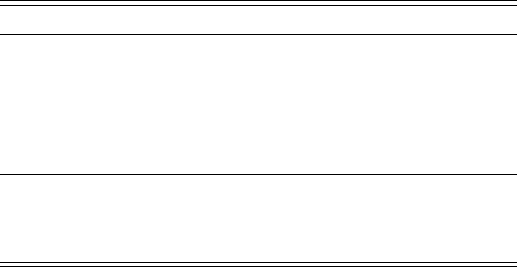

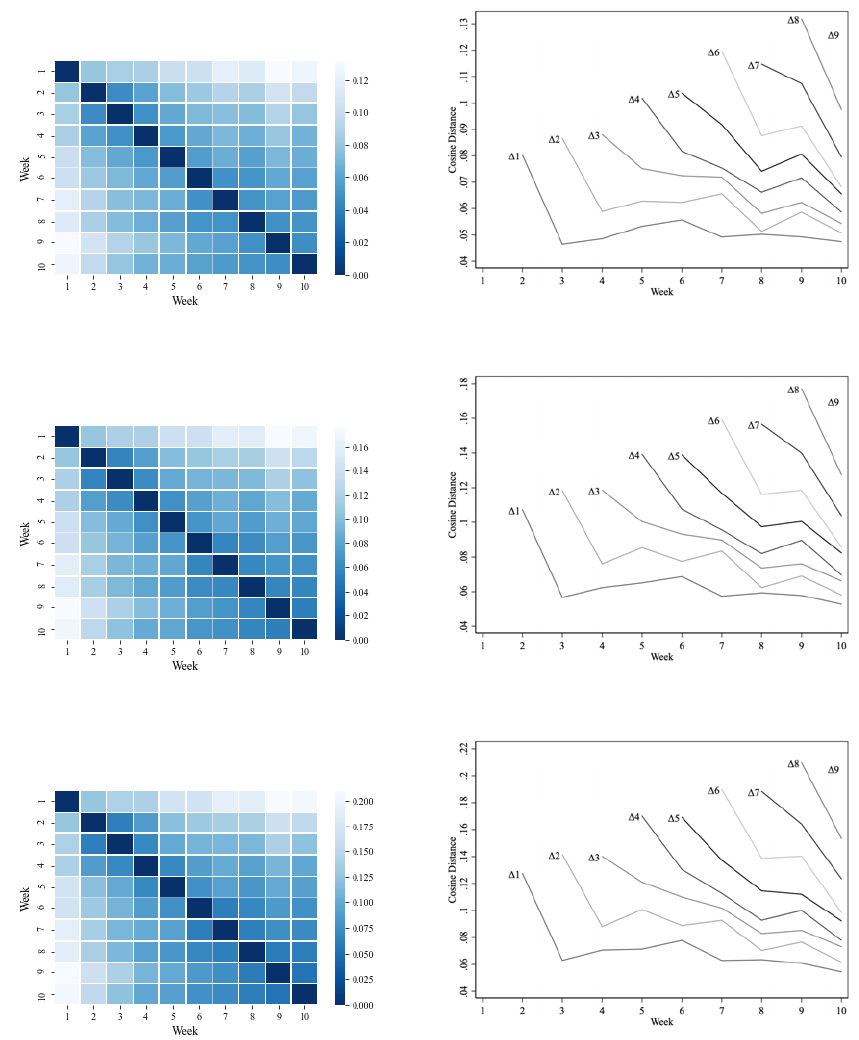

Figure 8 depicts a plot of the the cosine distances between week

w

and week ten

(the bottom gradient) for buyers and sellers. In this figure, we also depict the results

25

for (nested) subsamples with different experience levels, where we define experience by

the number of messages sent by that seller/buyer over our entire sample. Separating

by experience level will allow us to isolate the sellers for whom we are more likely to

observe patterns of learning. The scale of each plot is normalized to 1 in the last week;

we do this because sampling variation, which is more salient as we restrict the sample

size, biases the cosine distance measure upwards and makes levels uninterpretable.

22

Note also that the scales of panels (a) and (b) are different.

Panel (a) depicts the differences in messages between week

w

and week 10 for

buyers. The line for “All” includes all buyers, and corresponds directly to the values

in the bottom row of the heat map in panel (a) of Figure 7. For buyers with one, two,

or three or more messages, the cosine distance does not appear to be changing. For

buyers with four, five, and six or more messages, the cosine distance is decreasing over

time, but this is obscured by sampling variation due to the small number of buyers in

these sets.

In Panel (b), we again observe sharply different results for sellers. Here again, the

line for “All” includes all sellers, and corresponds directly to the values in the bottom

row of the heat map in panel (b) of Figure 7. For all samples, we see that as the

weeks get closer to week 10, seller messages are increasingly more similar in content

to the messages from this last week. Note also that the change is more pronounced

among more experienced sellers. For instance, we see the sharpest trend for sellers

that sent 6 or more messages, where there is a substantial difference in the cosine

distance between the set of week 1 and 10 messages and the set of week 9 and 10

messages. These patterns suggest that as the weeks pass, sellers may be adopting new

messaging strategies; moreover, it appears that repeat sellers are driving the changes

in Figure 7.

So far, we have established that repeat sellers’ messaging strategies are changing as

they accumulate experience. We would like to ask whether, in addition, the changes

are convergent, i.e. whether they represent a pattern that reflects learning. To do this,

we plot the cosine distance across different periods of the same length to see whether

the differences in message content are decreasing at a slower or faster rate over time.

The objects we are depicting correspond to the off-diagonal elements of the heat map

in Figure 7. The different off-diagonals represent differences over varying lengths of

22

See Appendix Figure A-6 for the non-normalized version.

26

Figure 8: The Bottom Gradient for Buyers and Sellers with Different Experience

Levels

(a) Buyer (b) Seller

Notes: This figure presents the cosine distance between the messages sent in weeks x and 10 for buyers, Panel (a),

and sellers, Panel (b). The cosine distance is scaled by the distance between week 9 and week 10 messages. Each

panel is cut by groups, where All includes our entire sample of buyers/sellers, 2+ indicates our sample of messages

sent by buyers/sellers who sent 2 or more messages, 3+ from our sample of messages sent by buyers/sellers who sent

3 or more messages, and so on.

time; we depict them all because we are concerned that high-frequency differences

may exaggerate the ratio of noise to signal.

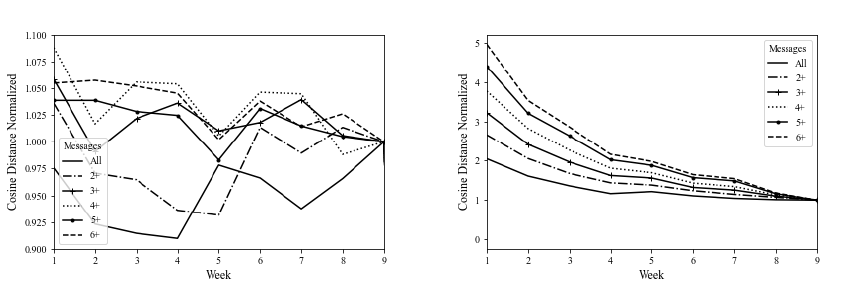

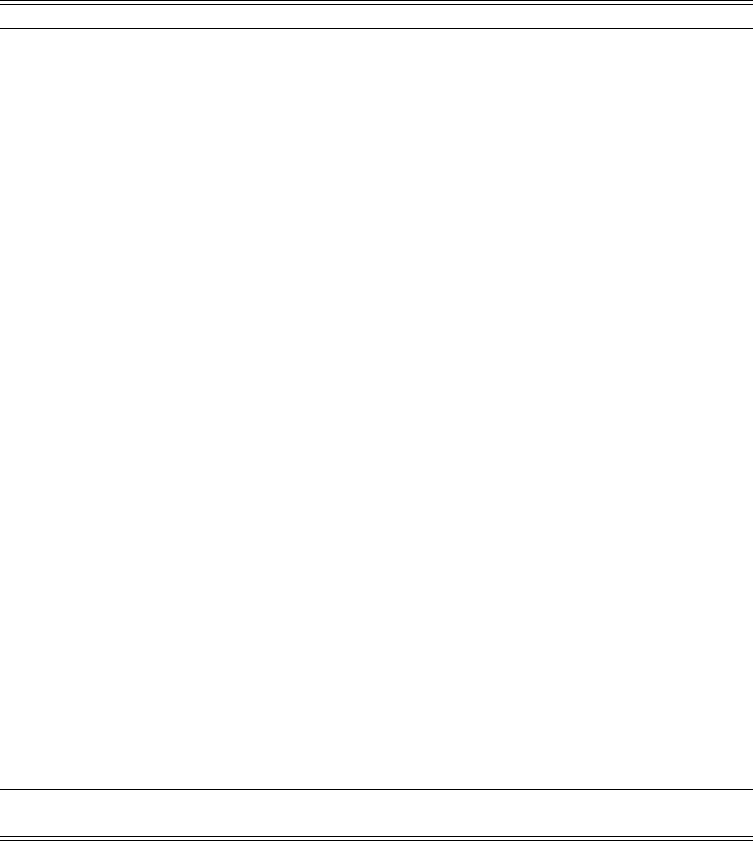

Figure 9, plots the off-diagonals for all buyers, Panel (a), and sellers, Panel (b). In

this plot, ∆

x

for week

w

corresponds to the cosine distance in messages between week

w

and week

w − x.

As suspected, Panel (c) portrays a noisy plot with no obvious

patterns in buyer messages; on the other hand, there appears to be a downward trend

in the ∆

x

’s in Panel (d). Thus, while seller messages are becoming more similar over

time, they do so at a declining rate.

Figure 9 depicts the off-diagonals corresponding to the “All” groups of Figure 8,

but from the latter we saw that repeat sellers are changing their messaging content

more than transient ones. So, in Figure 10 we reproduces the same exercise for sellers

who sent 5 or more messages in our ten-week period. As a reference point, the heat

map for this group of sellers is depicted in Panel (a). Already, we see starker patterns

in the change in message content across weeks. Panel (b) presents the off-diagonal

plot for this group of sellers. Again, the patterns that previously emerged for our

entire dataset of sellers become much more explicit when we restrict our analysis to

repeat sellers. For instance, from ∆5 in Panel (b) we can see that sellers’ messages

between weeks 8 and 3 are more similar than in comparison to the messages for weeks

27

Figure 9: Off-Diagonals for Buyers and Sellers

(a) Buyer (b) Seller

Notes: This figure displays the change in cosine distance of bigram counts in the messages for different periods of

time following May 25, 2016, separately for buyers, in Panel (a), and sellers, in Panel (b). ∆x for week w indicates

the cosine distance between week w and week w − x.

7 and 2 and weeks 6 and 1. Or in other words, as repeat sellers learn to use similar

messaging strategies over time, they are doing so at a declining rate as the weeks pass.

This convergent path in which sellers are changing their messaging content faster in

the beginning weeks following the messaging intervention, and then more slowly as

time goes by, is consistent with experienced sellers learning how to use messages to

facilitate transactions.

Most importantly, these results offer a simple explanation for the dynamics seen

in Section 4.2.3, where we find a time-variant effect of communication on bargaining

success that stabilizes following week five.

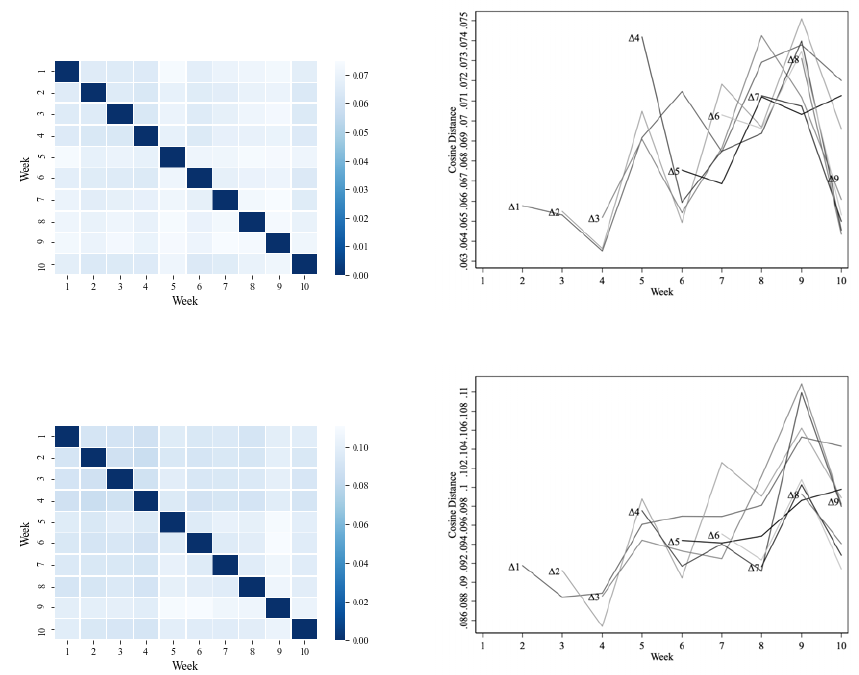

Further evidence is offered in Figure A-4 of the Appendix where we have included

the heat maps and off-diagonal plots for sellers who sent two, three, and four or more

messages. In addition, Figure A-5 in the Appendix presents the results for both sellers

and buyers who appear only once in our dataset. Here, the effects presented above

are completely attenuated when looking at this group of sellers, further providing

evidence that these patterns of convergence are due to changes in messaging content

by experienced sellers.

28

Figure 10: Convergence Among Sellers with Five or More Messages

(a) 5+ Messages (b) 5+ Messages

Notes: Panel (a) depicts the heat map representing the cosine distance of the bigram counts in the messages for each

pairing of weeks following May 25, 2016 for sellers that sent five or more messages. Panel (b) plots the off-diagonals

of the heat map from (a). ∆x for week w indicates the cosine distance between week w and week w − x.

6 Message Experience Predicts Success

In Section 4.2.3, we found a time-variant effect of communication on the success rate

of bargaining; namely, it took several weeks for the full effect on the success rate

to manifest. Similarly, the results from Section 5.3 indicate that seller messages are

changing over time, and that they are doing so in a convergent pattern.

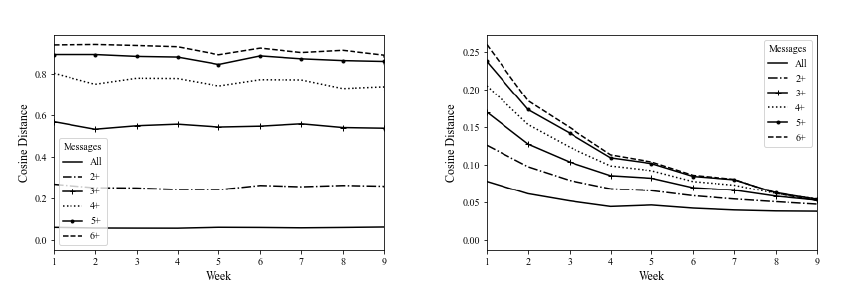

Given these findings, the natural next question is whether there exists a relationship

between the change in messaging content and bargaining success. Here, we are

motivated by the bottom gradient trends in Panel (b) of Figure 8. This figure shows

that seller messages are becoming more similar as the weeks approach week 10.

To explore whether these changes are associated with shifts in the seller success

rate, we calculated the cosine similarity between each message and the aggregated set

of bigram counts from the messages sent by sellers in week 10. We regress message

success, a binary variable representing whether that seller’s message ended in a sale,

onto this cosine similarity measure.

23

23

In this analysis we exclude a small set of sellers who send more than 20 messages. We do

this because we believe that a) they are qualitatively different, professional sellers and b) they are

overrepresented in message-level regressions. Overall, we are dropping 217 sellers that sent 21 or

more messages; this is out of our original sample of 60

,

076 sellers. In Appendix Section 4 we report

variations, including using all sellers and the set of sellers that sent fewer than 11 messages.

29

Table 6: The Relationship Between Message Success and Cosine Similarity

(1) (2) (3)

Sim(m, week 10) 0.0661

∗

0.0559

∗

0.0490

(0.0226) (0.0227) (0.0428)

Message Length 0.0013

∗

0.0003

(0.0002) (0.0005)

N 101931 101931 62217

Controls X X X

Seller FE X

Notes: This table presents our results on message success and a measure of message experience. Sim(m, week 10)

is the cosine similarity between a message and the set of week 10 messages excluding sellers who sent more than 21

messages. All models include our main set of controls: time trend; ln(ask price); category by condition fixed effects;

day of week, precipitation, holiday dummies, and the temperature. Likewise, all models drop sellers sending more

than 20 messages. Model (3) includes seller fixed effects. Robust standard errors are reported in parentheses and

∗

denotes statistical significance at α = 0.05.

Table 6 presents our results. In all specifications we include the same set of controls

as documented in Section 3.2. Finally, Models (2) and (3) also control for message

length, as measured by the number of tokens in the processed message. Model (3)

includes seller fixed effects.

In Model (1), we find a statistically significant effect that going from a completely

orthogonal message to a message containing the set of week 10 messages is associated

with an increase in the probability of success by 6

.

61 percentage points. In Model (2),

we further find that message length has a positive, but economically small, relationship

with the success rate. Finally, our result is no longer statistically significant, in Model

(3), when including seller fixed effects. We have only 3,134 sellers sending more

than five messages, but fewer than 21; as a result, we lose a considerable amount

of power in our estimates when restricting attention to within-seller variation. Still,

the relationship between our cosine similarity measures and message success remains

positive.

Altogether, Table 6 points to a positive correlation between the probability of

message success and the similarity between the message and the set of week 10 seller

messages. Notably, the point estimates from this table are similar in magnitude to

the point-estimates from Table 3, where we found that among our treatment group,

interactions that involved messages were 7.73 percentage points more likely to end in

success.

30

A limitation of our approach is that we have not been able to address the di-

rect mechanism in which messages contribute to higher rates of bargaining success.

While we cannot provide causal evidence on this front, we implement a distributed

multinomial model from Taddy (2015) in Appendix Section F. Here we consider the

relationship between the bigrams included in seller messages and the message number

sent by that seller, a measure of seller experience, which we have found to be related

to message success. This analysis attempts to further understand how seller messaging

content is changing, and through this descriptive exercise, we suggest some potential

strategies that sellers may be implementing.

Table A-7 then presents the bigrams, both in English and the original German,

that are the most and least predictive of seller experience, conditional on a set of

controls. In addition, we use the bigram coefficients estimated from our model to

compute message experience scores; here, a higher score indicates a message associated

with higher levels of seller experience. Table A-8 then shows the messages with the

highest experience scores, while Table A-9 includes the messages with the lowest

scores.

Among the messages that are most correlated with experience, we see an emphasis